How much does automotive business insurance cost?

Several factors contribute to the cost of auto service business insurance, including the size of your automotive business and its risks. Cost estimates are sourced from policies purchased by Insureon customers.

Key insurance policies and their expected costs for auto service businesses

Here are the top commercial insurance policies purchased by automotive businesses and their average monthly costs:

- General liability insurance: $54 per month

- Garage keepers insurance: $38 per month

- Business owner's policy (BOP): $145 per month

- Workers' compensation insurance: $148 per month

- Commercial auto insurance: $76 per month

Our figures are sourced from the median cost of small business insurance policies purchased by Insureon's auto service customers. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

The cost of business insurance depends on a number of factors, including the types of automotive services you offer, the kinds of vehicles you work on and their value, your annual revenue, the value of your equipment and property, your location, number of employees, and policy limits and deductibles.

General liability insurance

Auto service businesses pay an average of $54 per month, or $650 per year, for general liability insurance.

A general liability policy helps cover legal fees related to common third-party lawsuits from clients, including those related to customer bodily injury, damage to a client's property, and advertising injury.

This is the average general liability policy for automotive companies that buy from Insureon:

Insurance premium: $54 per month

Policy limits: $1 million per occurrence; $2 million aggregate

The cost of general liability insurance depends on several factors, such as the coverage limits you choose, the size of your business, the amount of foot traffic you have, and any endorsements you may add, such as an additional insured.

The cost of general liability insurance depends on your industry risk

General liability insurance costs depend on your risk of a customer lawsuit.

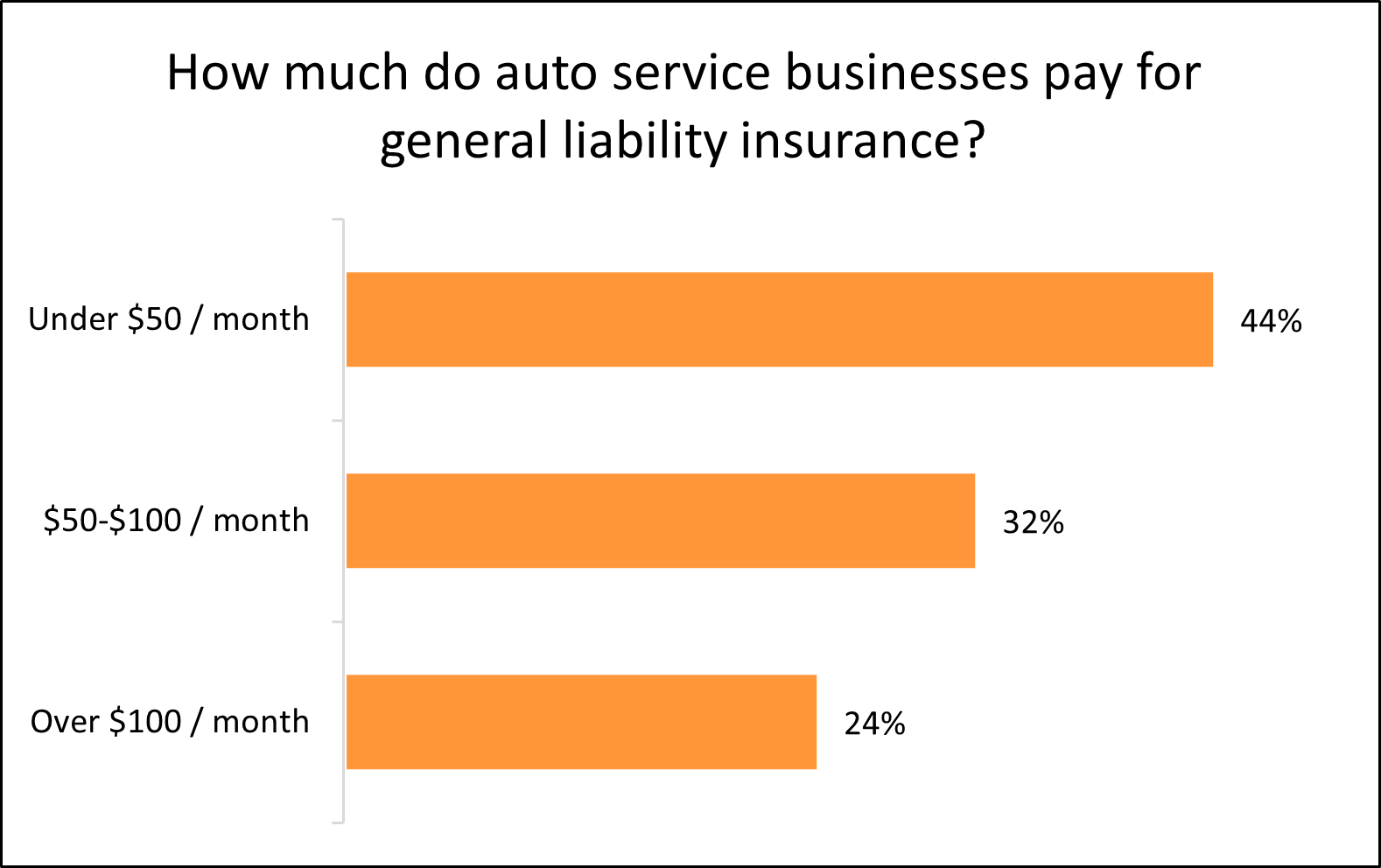

Among auto service businesses that purchase general liability insurance with Insureon, 44% pay less than $50 per month and 76% pay less than $100 per month.

Across all auto service professions, learn how to find affordable general liability insurance.

Common general liability limits for auto services

Policy limits are the maximum amounts your insurance company will pay for covered claims.

The per-occurrence limit is the most your insurer will pay for a single incident, while the aggregate limit is the maximum your insurer will pay on any claims during your policy period, typically one year.

Most auto service businesses (97%) choose general liability policies with a $1 million per-occurrence limit and a $2 million aggregate limit. As your small business grows, you may need to expand your policy limits.

Garage keepers insurance

On average, auto service professionals pay a $38 monthly premium, or $458 annually, for garage keepers insurance.

When you buy garage liability insurance, a type of general liability coverage specifically for garage-based and other auto service businesses, you can often add garage keepers insurance to your policy as an endorsement.

This type of business insurance protects your customers' vehicles while they're in your care, custody, and control. For example, if someone broke into your garage and damaged a customer's vehicle, garage keepers insurance would pay for legal expenses and the cost of repairs.

This is the average garage keepers insurance policy for automotive businesses that buy from Insureon:

Insurance premium: $38 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500

The cost of garage keepers insurance depends on many factors, include your type of business, the location of your business, and the types of vehicles you deal with.

Business owner’s policy

Auto service small business owners pay an average of $145 per month, or $1,741 per year, for a business owner’s policy.

A business owner's policy, or BOP, bundles general liability coverage with commercial property insurance to cover both third-party risks and your business property. It typically costs less than purchasing each policy separately.

A BOP protects against customer injuries and property damage. It also covers damage to your physical building and auto service equipment and inventory. Because of its increased coverage and affordability, it’s the policy most often recommended by Insureon’s agents for small businesses that own or rent a building.

This is the average BOP for automotive businesses that buy from Insureon:

Insurance premium: $145 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $1,000

Small, low-risk auto service companies are often eligible for a business owner's policy. Automotive businesses that are medium-sized and/or higher risk should consider a commercial package policy (CPP).

A commercial package policy also combines your general liability coverage with property insurance, but offers more flexible protection options than a BOP. The average cost of a CPP for auto service businesses is $89 per month, or $1,067 per year.

Auto service business owners may see higher costs if they choose to add endorsements to their policy. Insurance endorsements, such as business interruption insurance or equipment breakdown coverage, are often recommended to help avoid financial losses if a fire or power outage forces your business operations to cease for an extended period of time.

The cost of a business owner's policy is based on a number of factors, including the value of your property, where you are located, the number of employees you have, and your specialty.

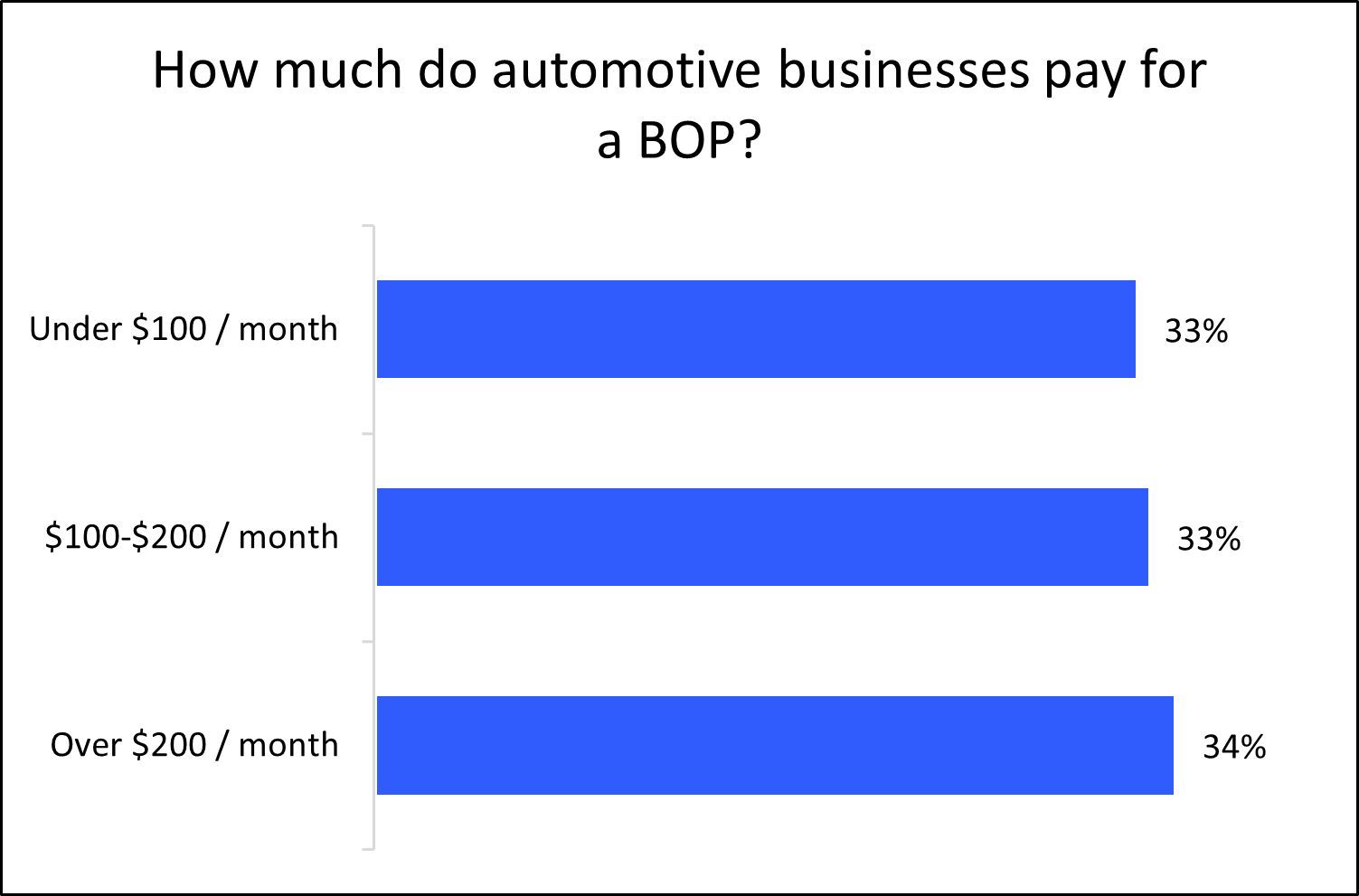

The cost of a BOP increases with the value of your property

Among auto service businesses that purchase a business owner’s policy with Insureon, 33% pay less than $100 per month and 66% pay less than $200 per month.

Businesses with large or more expensive business property will typically pay more for a BOP than auto service businesses with smaller premises or lower value business property. Your industry risk, years in operation, and claims history will also affect your premium.

Workers’ compensation insurance

For auto service companies, workers’ compensation insurance costs an average of $148 per month, or $1,774 per year.

This business insurance coverage helps pay for medical expenses when an employee is injured on the job. It also provides disability benefits while they're recovering and unable to work.

To comply with your state’s requirements and avoid penalties, auto service businesses typically must purchase this coverage for their employees. It's also recommended for sole proprietors, as health insurance plans can deny insurance claims for medical bills when an injury or illness is related to your job.

Most policies include employer's liability insurance, which covers the cost of lawsuits related to employee injuries. There's usually no limit to how much a workers' comp policy can pay for employee benefits, though it depends on state laws.

The cost of workers' compensation insurance depends on several factors, including the number of employees you have and the level of risk involved with their jobs.

Get more information on how to find affordable workers' compensation coverage.

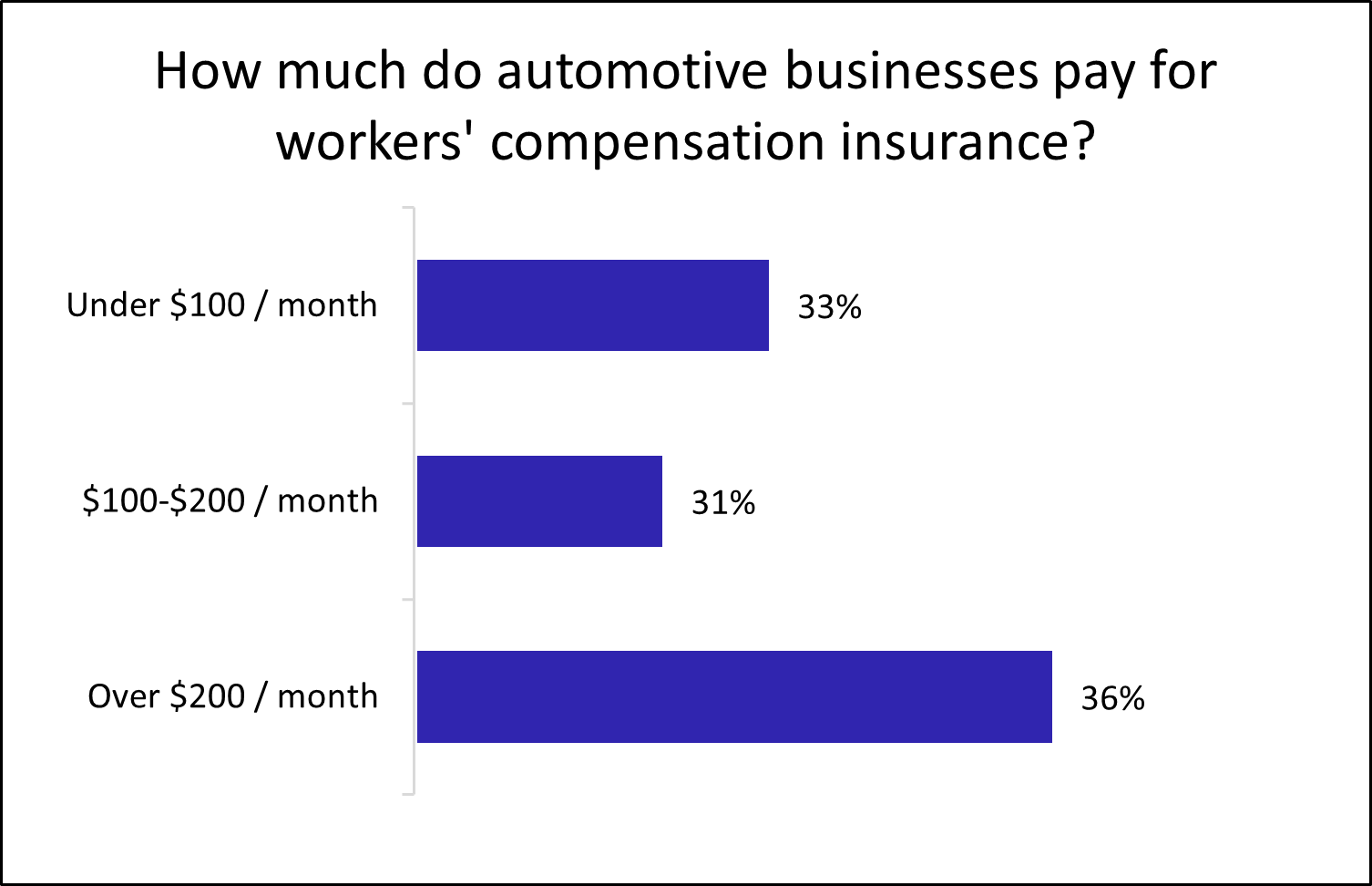

The cost of workers’ comp depends on the number of employees

Among automotive companies that buy workers’ compensation insurance with Insureon, 33% pay less than $100 per month and 64% pay less than $200 per month.

Workers' comp costs depend on the number of employees you have in your small business. A larger workforce brings a higher risk of worker injuries, which is why bigger businesses tend to pay more for this type of insurance.

Commercial auto insurance

The average cost of commercial auto insurance for automotive professionals is $76 per month, or $909 annually.

Most states require this coverage for vehicles owned by an auto service business. For personal, rented, and leased vehicles used for business purposes, look to hired and non-owned auto insurance (HNOA) instead.

A commercial auto insurance policy provides financial protection in the event of an accident involving your business vehicle. It can help pay for property damage, medical costs, and legal expenses.

This coverage only applies to your business-owned vehicles. For coverage of your customers' cars, look to garage keepers insurance. This will need to be purchased separately from your standard auto insurance policy, and isn't calculated into commercial auto costs.

Commercial auto insurance rates depend on several factors, including the policy limits you choose, the types of vehicles you own and their value, the driving records of anyone permitted to drive, and any add-on coverages you select, such as additional insured endorsements and comprehensive coverage.

Learn more about how to find affordable commercial auto insurance coverage.

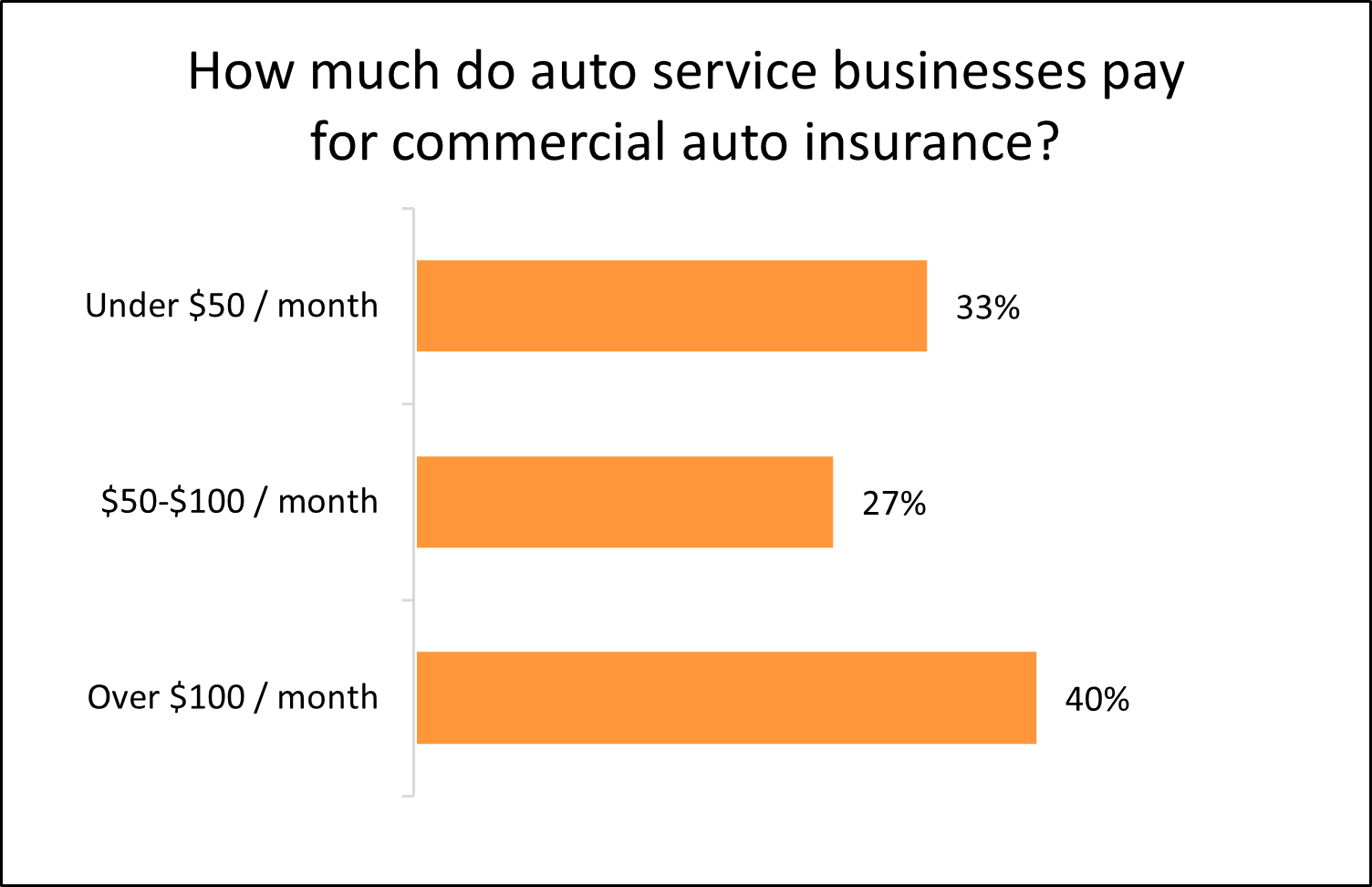

The number of vehicles and their use determine commercial auto costs

Among automotive businesses that buy business auto insurance with Insureon, 33% pay less than $50 per month and 60% pay less than $100 per month.

Commercial vehicle insurance costs are determined by many factors, including your work vehicle's value, how often it's driven, and how many vehicles you own.

A company with a larger fleet of vehicles, especially those of higher value and that are driven regularly, have an increased risk of accidents and/or vandalism. For this reason, these types of companies tend to pay a higher premium for car insurance than a small business with fewer vehicles and lower value vehicles.

How do you buy auto service business insurance with Insureon?

Insureon works with top-rated U.S. providers to find affordable insurance coverage for your auto service business, whether you work independently as a car repair mechanic, or own a car dealership company with several employees.

Apply today to get free quotes with our easy online application. A licensed insurance agent who specializes in your profession's unique risks will help you find the right types of coverage for your business needs. They can also discuss auto service insurance requirements and expected liability insurance costs.

Typically, you can get a certificate of insurance within 24 hours after submitting an application, offering instant peace of mind.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy