Term: Hired and non-owned auto insurance

Hired and non-owned auto insurance (HNOA) is a type of insurance for small business owners who rent or lease vehicles, or ask employees to use their personal vehicles for business purposes.

How hired and non-owned auto insurance protects your business

If you or an employee gets into an accident while driving a leased, rented, or personal vehicle for business purposes, hired and non-owned auto insurance will make sure any resulting lawsuits won’t bankrupt your business.

Hired and non-owned car insurance provides insurance protection while driving vehicles your business doesn't own for work purposes.

It covers legal expenses that result if you or an employee has an accident. It also closes a gap with most commercial auto insurance policies which excludes coverage for accidents involving business use of vehicles not titled to the company.

If you or one of your employees is held liable for another person's property damage or injury, your insurance will cover attorney's fees, settlements, or court-imposed judgments.

However, hired and non-owned auto insurance does not cover:

- The costs to repair the leased, rented, or employee-owned car, van, or truck

- Accidents that happen while employees are commuting to work

- Incidents that occur while employees are running personal errands during the workday

Who needs hired and non-owned auto insurance?

Small businesses that frequently rent cars for business travel, lease vehicles for long-term periods, or ask employees to use their personal vehicles for business errands are good prospects for hired and non-owned car insurance. So are those that often rely on employee vehicles during peak work periods.

Companies in these industries may need HNOA insurance protection:

Which small businesses are eligible for hired and non-owned insurance?

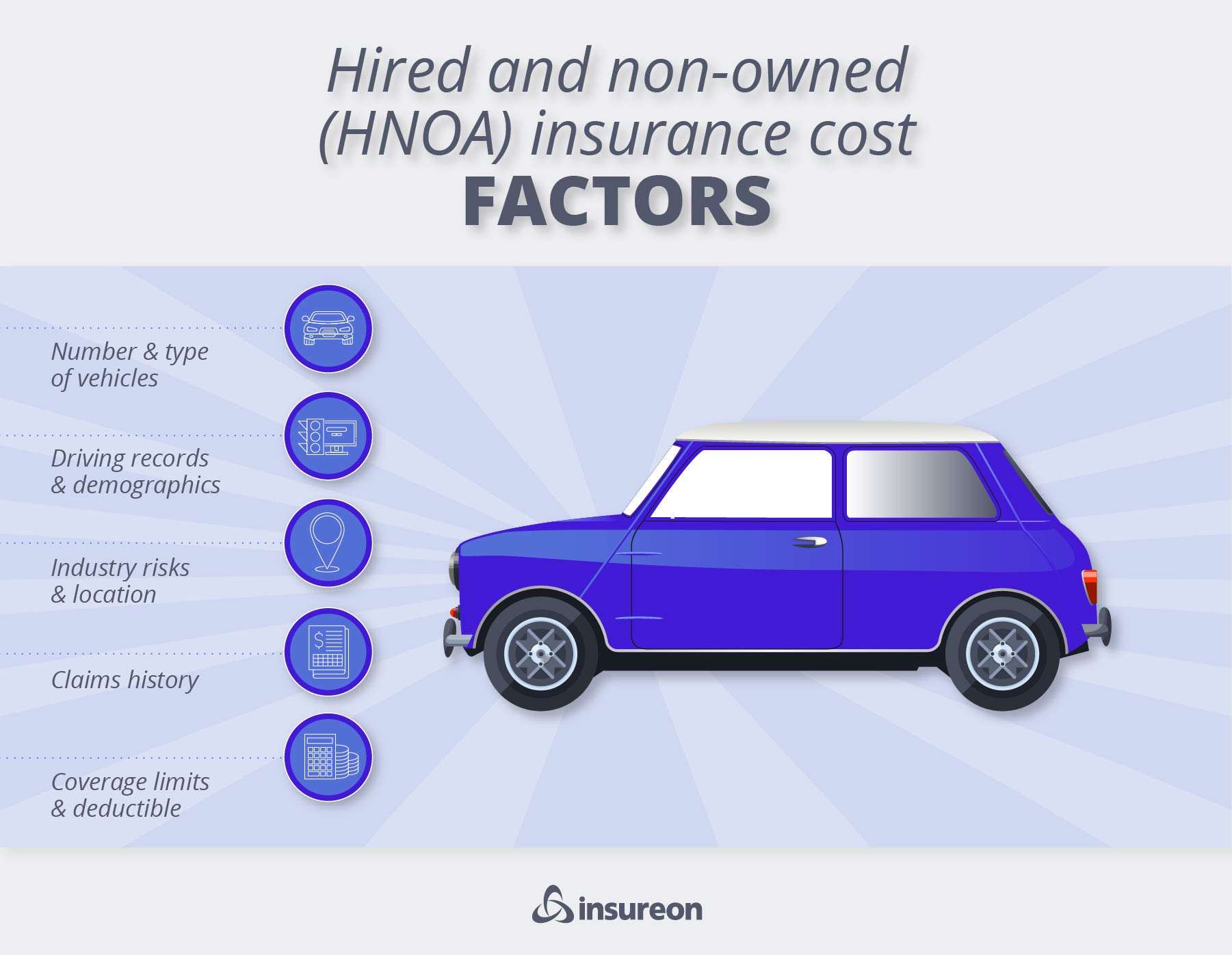

Hired and non-owned auto insurance is available to any small business that can fulfill an insurer’s underwriting requirements. These are based on information such as a company's size, credit history, and prior auto insurance claims.

Companies that fail to demonstrate financial responsibility and a safe driving history may be denied insurance or charged a higher premium.

This policy is typically not available as a standalone policy. It can be added to your general liability insurance, or to the general liability portion of a business owner's policy.

Find free insurance quotes from trusted U.S. providers

Insureon helps small business owners compare quotes for general liability insurance and other policies from top-rated U.S. carriers. Start a quote today to protect your business against car accidents and other common risks.

What our customers are saying

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy