Commercial auto vs. personal auto insurance

The line between a personal vehicle and a commercial vehicle is sometimes unclear. Find out which types of auto insurance cover vehicles used for work.

What's the difference between commercial and personal auto insurance?

There are a few key differences between commercial and personal auto coverage.

When your business owns the vehicle, then you need commercial auto insurance. It'll cover you, your employees, and even personal errands.

With personal auto insurance, it's perfect for the morning commute, but won't cover accidents on the clock.

When it comes to pricing, a commercial auto insurance premium can cost up to 150 dollars per month, depending on the industry you work within and your coverage needs.

Are you self-employed? There are auto policy options for you too.

Click the link below to find the right auto policy for your business.

For small businesses, the line between what is considered a personal vehicle and a commercial vehicle is often blurry. Sometimes small business owners and employees use their personal vehicles for business purposes. For example, they might use their own car to travel to job sites, transport equipment, or deliver goods.

Personal auto insurance policies almost always exclude business use. That means you're not covered if you get into an accident while driving for work (with the exception of your commute).

What is commercial auto insurance?

The main difference between personal and commercial auto insurance is who owns the vehicle. If your business owns a vehicle, it must be covered by commercial auto insurance.

Both personal and commercial auto policies pay for legal expenses, bodily injuries, and property damage related to auto accidents. However, commercial auto insurance usually covers higher claims, different types of vehicles, and more complex legal issues.

This type of insurance coverage typically includes all the business’s employees as additional insureds, which means every employee with a valid license can drive your company vehicle. The cost of commercial car insurance is affected by their driving records, along with the policy's coverage limits and deductible.

Commercial auto insurance covers business vehicles

If you're a sole proprietor who owns a vehicle used primarily for business, or if you're starting a business with a fleet of company vehicles, you may need commercial auto insurance. Commercial coverage typically has higher liability limits than personal auto insurance. It can cover cars, trucks, limos, and vans used to:

- Transport goods or equipment

- Drive clients or employees

- Perform a service that you’re paid for

- Charge passengers a fee to ride in your vehicle

- Charge people a fee to transport goods in your vehicle

- Haul heavy, work-related loads, such as a dump truck

- Tow a trailer used for business

Does commercial auto insurance cover personal use?

Commercial auto insurance typically covers employees who are given permission to drive your business vehicle. This policy will help pay the costs of accidents when an employee is driving, even if the vehicle was used for personal reasons.

So, what about personal vehicles occasionally used for work? That's where a policy called hired and non-owned auto insurance (HNOA) comes into play.

What is hired and non-owned auto insurance?

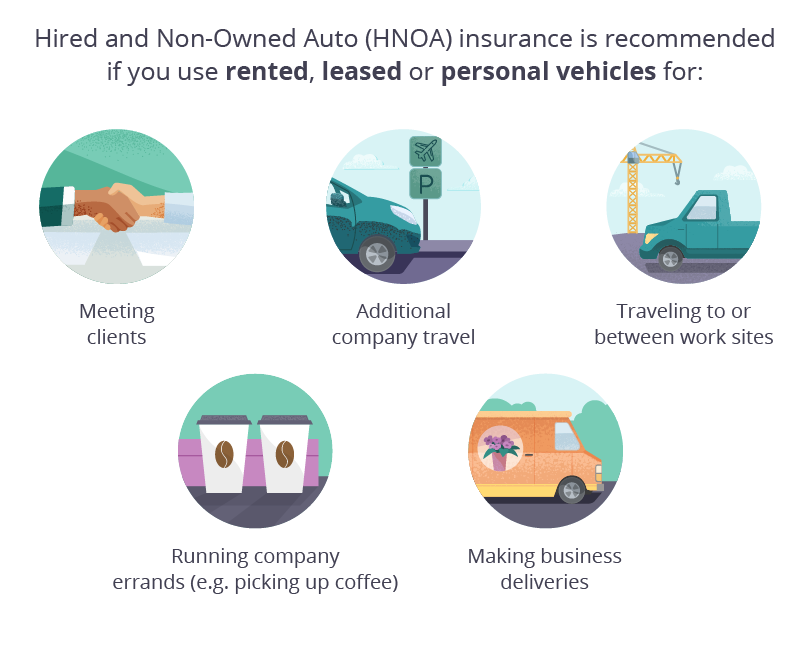

If you or your employees use a personal vehicle for work errands, you should consider purchasing hired and non-owned auto insurance. This policy provides liability coverage if you get into an accident while driving your own vehicle for work purposes. It also provides protection when your business rents or leases a vehicle.

This policy only covers legal bills resulting from an accident, not physical damage. For example, it won't pay for repairs if your vehicle is damaged in an accident.

HNOA covers personal, leased, and rented vehicles used for work

You may want to purchase this liability insurance if:

- Your employees run work errands in their personal vehicles

- You rent a car for a business trip

- Your company leases vehicles

What is personal auto insurance?

Personal auto insurance only covers accidents that occur while you’re driving your vehicle for personal use. That includes commuting to and from work and travel unrelated to your job duties. Policies typically insure the owner of the vehicle and one or two immediate family members.

Your personal car insurance won't cover business use

Most personal auto policies specifically exclude business use. If you get into an accident while driving for work, your insurance company will likely reject your claim.

In some cases, personal auto insurance might include limited coverage for business use. Check with your insurance company to find out exactly what is and isn't covered.

How much does commercial auto insurance cost vs. personal auto insurance?

In general, commercial auto insurance costs more than personal auto insurance. That's because commercial policies tend to have higher limits, which means more coverage in the event of an accident.

A personal auto policy usually covers one person driving their own car, but a commercial policy covers an entire business. That could include multiple drivers, multiple vehicles, trucks, and employees with poor driving records.

Insureon customers pay an average premium of $147 per month, or about $1,762 annually, for commercial auto insurance, regardless of policy limits. Like your personal auto insurance policy, your insurance company calculates your commercial vehicle insurance premiums based on a number of factors.

However, commercial auto insurance doesn't have to be expensive. It depends on the specifics of your business. A small business where one or two people drive a company car will have a much lower premium than a big business with a fleet of vehicles and numerous drivers.

Factors that affect the cost of commercial car insurance include:

- Your industry risks

- The type of vehicles you own

- The number of vehicles

- How often the vehicles are driven

- Employee driving records

- The type of coverage you choose

- The policy limits you choose

- Auto insurance claims history

Get auto insurance quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to compare quotes for commercial auto insurance and other business insurance policies from top-rated U.S. providers. Our licensed insurance agents can help you find the right coverage for your small business.

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy