Workers’ compensation insurance for photographers and video businesses

Workers’ compensation insurance covers medical costs and disability benefits for work-related injuries and illnesses. This policy is required in almost every state for photo and video businesses that have employees.

Workers’ comp protects employees at your photography or videography business

If a photography assistant is injured after falling at an on-location shoot, or a gaffer trips over an extension cord, it can lead to expensive medical bills, not to mention lost time at work.

Workers’ compensation insurance can pay for medical expenses if an employee is injured at your photography studio or out on a shoot. It can cover ambulance rides, surgery, rehabilitation expenses, and part of the wages the employee would lose while unable to work.

Workers’ compensation can help pay for an injured employee’s:

- Immediate medical costs, such as an ambulance ride and emergency room expenses

- Ongoing medical costs, such as medication and physical rehabilitation

- Partial lost wages while an employee is recovering and unable to work

Workers’ comp protects photo and video business owners

Typically included in a workers’ comp policy, employer’s liability insurance provides protection if an employee sues a business owner over an injury.

For example, if an employee mentions a work-related injury and you fail to take action, that employee could file a lawsuit months later if the condition worsens. In that case, employer's liability insurance can help cover:

- Attorney’s fees

- Court costs

- Settlements and judgments

Even if a lawsuit is frivolous, you could find yourself paying out of pocket for a costly legal defense if you don't have the protection included in a workers’ comp policy.

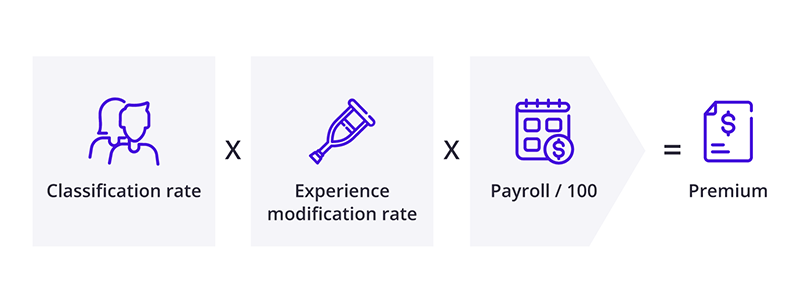

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers’ comp requirements for photo and video businesses

The laws regarding workers’ comp will vary depending on where your employees live, since the requirements are set at the state level. For example, photography and videography businesses in California are required to carry workers’ compensation insurance as soon as even one employee is hired. However, in Georgia the workers’ comp requirement doesn’t kick in until a business hires its third employee.

While sole proprietors, independent contractors, and partners don’t have to carry this policy, you can purchase workers’ compensation to protect yourself and your livelihood, too. It's always a good idea to carry workers' comp because health insurance can deny claims for injuries that are related to your job.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, photo and video businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

How much does workers' compensation insurance cost for photo and video businesses?

Most photo and video businesses pay an average of $56 per month for workers' comp coverage, but you could pay more or less depending on your risks.

Photographer insurance costs are based on a few factors, including:

- Types of photo and video services offered

- Value of business property, such as photography equipment, editing and lighting equipment, memory cards, etc.

- Annual business revenue

- Where your business operates

- Number of employees

- Coverage limits, deductible, and number of additional insureds

Manage your risks to lower workers’ comp costs

Shooting photos, short videos, or films may not seem like a dangerous profession, but it’s not without risk. Injuries can happen in any workplace. A cameraperson could get hit in the face with a boom mic, or a photo developer could trip on a cord in a darkroom. If an employee is hurt while working it could lead to an insurance claim – and a rise in your premium.

You and your crew often need to work quickly to get a shot, but you should also make sure everyone is working safely. Manage the risks you and your employees face by providing periodic safety training and eliminating potential hazards promptly, such as a broken step or a wet floor. Taking these steps could reduce workplace injuries along with insurance rates.

Other important insurance policies to consider

Workers’ compensation insurance offers protection for your employees, and to some extent your business, but it doesn’t provide coverage for all risks. Photo and video businesses may also need:

- General liability insurance: This policy protects against basic photography and videography risks. It can cover damage to a client's property, or a slip-and-fall injury at your studio that leads to a lawsuit.

- Business owner’s policy (BOP): A BOP bundles general liability insurance with commercial property insurance at a lower rate than purchasing both policies separately. If a client is injured at your office or a thief steals your camera equipment, your BOP can cover the costs.

- Professional liability insurance: Also called errors and omissions insurance (E&O), this policy covers lawsuits related to work performance. For example, if a wedding videographer misses the bride and groom’s first kiss, or a photographer accidentally deletes the images from a catalog shoot, professional liability insurance can pay for legal expenses if the client sues.

- Commercial auto insurance: Photo and video businesses that own a vehicle typically must carry commercial auto insurance to comply with state laws. This coverage helps you recover from accidents involving your business vehicle.

- Equipment insurance: A standard commercial property policy only covers business property at your company location, which is why photo and video professionals often invest in equipment insurance, also called inland marine insurance. This policy covers your cameras and other business property wherever you take it.

Get free quotes and buy online with Insureon

Are you ready to protect your photography or videography business with workers’ compensation insurance? Complete Insureon’s easy online application today to get quotes from top U.S. insurance companies.

You can speak with a licensed insurance agent to find the best, most affordable coverage for your unique risks. Once you find the right policy, you can begin coverage and receive a certificate of insurance in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy