Workers’ compensation insurance for manufacturers

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Workers’ comp protects employees at your manufacturing business

Whether they work in production, shipping and receiving, transportation, or office administration, your manufacturing employees face daily risks. If there’s an accident and an employee is hurt, it can lead to costly setbacks or even a lawsuit.

Workers' compensation insurance can cover medical bills and other related expenses when a production worker or another employee is injured on the job. This coverage is a good idea even when it's not required, as it provides financial protection against work injury claims that health insurance could deny.

Workers’ compensation can help pay for an injured employee’s:

- Immediate medical costs, such as an emergency room visit

- Ongoing medical costs, such as pain medication

- Partial lost wages while the employee is unable to work

Workers’ comp protects manufacturing business owners

Usually included in a workers’ comp policy, employer’s liability insurance provides protection when a production worker, office clerk, or other manufacturing employee decides to sue a business owner over an injury.

Employer’s liability insurance can help cover:

- Attorney’s fees

- Court costs

- Settlements

Without insurance, you could find yourself paying for a costly legal defense, even if you weren’t at fault. However, employer’s liability insurance does have limits to how much it will pay for a lawsuit.

How much does workers' comp cost for manufacturing businesses?

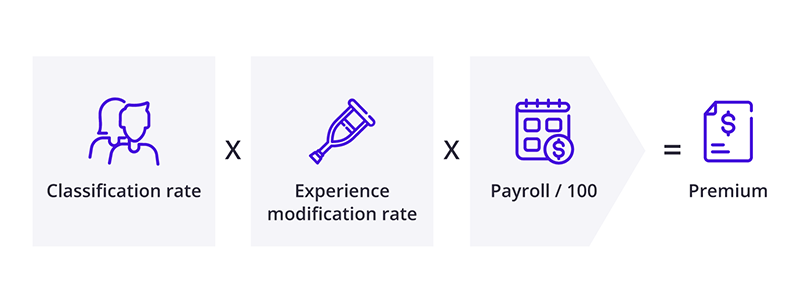

The amount you pay for workers’ compensation is a specific rate based on every $100 of your business’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

The formula providers use in underwriting to calculate workers' comp rates is:

State laws set workers’ comp requirements for manufacturing businesses

Each state creates its own laws for workers’ compensation requirements. For example, food and beverage manufacturing businesses in New Hampshire must carry workers’ compensation insurance for their employees. However, Mississippi manufacturers are only required to carry workers’ compensation when they have five or more employees.

While independent contractors, sole proprietors, and partners don’t have to carry workers’ compensation insurance, you can purchase a policy to protect yourself, too. Even when it's not required, you might choose to buy it due to the potentially high costs of a work injury.

Workers' compensation laws in your state

Monopolistic state funds for workers’ compensation

In certain states, manufacturing businesses must purchase coverage through a monopolistic workers' comp state fund. Those states are:

If you purchase workers’ comp through a monopolistic state fund, it might not include employer’s liability insurance. However, you can purchase it as stop gap coverage from a private insurance company.

Lower workers’ comp costs with risk management

From hazardous production line machinery to repetitive motion injuries, your employees face many risks. Manufacturers can create a safer work environment with:

- Employee safety training

- Proper equipment, such as gloves and goggles

- Equipment maintenance

- Regular employee breaks to prevent repetitive motion injuries

By maintaining a safe work environment, you can decrease workplace accidents. That means fewer claims – and a lower insurance premium.

How much does workers’ compensation insurance for manufacturers cost?

Manufacturers pay an average of $154 per month, or $1,852 per year, for workers’ compensation insurance.

Manufacturing insurance costs are based on several factors, including:

- The type of products that are manufactured

- Manufacturing operations

- Annual business revenue

- Location

- Number of employees

- Risk control measures in place

- Coverage limits and deductible

Other important policies for manufacturers

Workers’ compensation insurance protects your employees and to some extent your business, but it doesn’t cover common risks such as property damage and customer injuries. Other recommended manufacturers’ insurance policies include:

General liability insurance: This is often the first policy purchased by small business owners. It covers legal expenses related to customer property damage and injuries, and usually includes product liability insurance to cover harm caused by your products.

Business owner’s policy (BOP): This policy bundles general liability coverage with commercial property insurance, usually at a lower rate than if the policies were purchased separately.

Cyber insurance: Any business that handles credit card numbers or other personal information should carry cyber insurance. It helps businesses recover from costly cyberattacks and data breaches.

Commercial auto insurance: This policy pays for injuries and property damage caused by your manufacturing business's vehicle. It's required in most states for vehicles owned by a business.

Commercial umbrella insurance: Similar to excess liability insurance, this policy boosts coverage on a general liability, employer’s liability, or commercial auto insurance policy once the limit is reached.

Get free quotes and buy online with Insureon

Are you ready to safeguard your manufacturing business with workers’ compensation or another type of insurance? Complete Insureon’s easy online application today. Once you find the right policy, you can begin coverage in less than 24 hours.

Verified workers' compensation insurance reviews

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy