How much does small business insurance cost?

Small business insurance costs depend on your industry, your business location, and its size. With over 450,000 small businesses served, we have a wide range of cost data from policies purchased from trusted providers since 2011.

What is the average cost of small business insurance?

The first policy that most small business owners need—and also the least expensive one—is general liability insurance. This policy protects against customer accidents that lead to costly lawsuits. The average cost of a general liability policy is $42 per month or $500 per year.

General liability coverage is often bundled with commercial property insurance at a discount in a package called a business owner's policy (BOP). A BOP provides financial protection against the most common lawsuits and property losses at an affordable price, making it the best choice for a small business. The average cost of a business owner's policy is $57 per month or $684 annually.

The table below shows average costs for our top small business insurance policies. These figures are sourced from the median cost of policies purchased by 40,000 Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Average monthly small business insurance costs

| Business insurance policy | Average cost |

|---|---|

$42 | |

$57 | |

$61 | |

$45 | |

$75 | |

$145 | |

$67 |

Verified business insurance reviews

Hear from customers like you who purchased small business insurance.

Understanding small business insurance cost factors

Your insurance provider will typically calculate your premiums based on several different factors about your business. The factors that impact your cost can vary depending on the types of coverage that your business needs.

The size of your business, its location, and the type of work you do are all key factors in determining your insurance rates. The average insurance costs for small businesses, listed above, can give you a general idea of how much you could pay for coverage.

Here's a quick look at the factors that affect the cost of general liability insurance coverage and other types of small business insurance:

Policy limits

Your policy's limits are the maximum amounts of coverage it can provide, usually $250,000 to $2 million or more. If you want a policy that covers more expensive insurance claims, expect to pay more than you would for basic coverage.

General liability insurance is an occurrence-based policy. It pays for losses that occur during the policy period and has two limits:

- Per-occurrence limit. The insurer will pay up to this amount to cover claims related to a single incident.

- Aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to this amount to cover claims.

Most Insureon customers choose a general liability insurance policy with a $1 million per-occurrence limit and a $2 million aggregate limit, which costs an average of $42 per month. The average premium increases to $46 per month for customers who choose a policy with $2 million per-occurrence / $4 million aggregate limits.

Professional liability or errors and omissions insurance (E&O) policies are claims-made and only cover claims filed while your insurance is kept active. If you want the ability to file a claim after the policy expires, you can buy tail coverage for an additional cost.

The right amount of insurance coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

Deductibles

The deductible is an amount you must pay out of pocket before you can make a claim on your policy. The average deductible that Insureon customers select for general liability insurance is $500.

Choosing a higher deductible is an easy way to lower your premium. However, make sure it's an amount you can easily afford. If you can’t pay for it in a crisis, your insurance won’t activate to cover your claim.

Your industry

When deciding how much to charge for a policy, your industry is a top consideration for insurance companies. Insurers take into account any risks that might increase the chance of expensive or frequent claims, such as hazardous machinery that could injure workers, or a specific profession that often incurs malpractice lawsuits.

Here are several examples of businesses in high-risk industries:

- Businesses that engage with the public pay more for general liability insurance, which covers third-party bodily injuries and property damage. That means general liability insurance costs are higher for retailers, but lower for consultants who work on their own.

- Commercial auto insurance costs depend on the type of driving you do. Trucking businesses can expect to pay more for this coverage, as opposed to small businesses that own a company car.

- The professional services or advice you provide determines the cost of professional liability insurance. If similar businesses have a history of claims, that means increased costs for your business too.

- Healthcare and finance businesses that store medical records, credit card numbers, or other personal information can expect higher premiums for cyber insurance, which covers costs in the event of a data breach or cyberattack.

- IT consultants and tech companies often pay more for a specialized form of cyber insurance, technology E&O, to protect against data breach lawsuits.

- Retailers, restaurants, and others that depend on a physical location to conduct business face bigger losses in the event of a forced closure from a fire or storm, which is why they can expect higher premiums for business interruption insurance.

You might also run into insurance requirements for your industry. For example, construction businesses and installation contractors are often required to carry general liability insurance.

Average monthly business insurance costs by industry

| Industry | General liability | Business owner's policy | Workers' comp |

|---|---|---|---|

$30 | $46 | $34 | |

$82 | $98 | $254 | |

$48 | $76 | $136 | |

$31 | $70 | $60 | |

$44 | $148 | $106 | |

$29 | $48 | $50 | |

$73 | $118 | $193 | |

$51 | $94 | $169 | |

$29 | $42 | $40 | |

$29 | $45 | $39 |

Business location

Your location can influence the cost of business insurance in several ways.

For example, businesses in an area with high crime or increased foot traffic may pay more for insurance that covers theft or customer accidents. Those in districts with expensive real estate can expect higher rates, as property damage claims will likely be higher.

Your state also affects when you need insurance and how much it will cost:

- Most states mandate workers' comp insurance for businesses that have employees. Premiums are often higher in states that pay more for healthcare.

- Almost every state requires commercial auto insurance for vehicles that are owned by a business. Your premium will partly depend on the cost of medical care, car repairs, and litigation in your area.

Finally, you may need a certain policy to work in a particular location. For example, businesses in real estate, insurance, or healthcare may need professional liability insurance (also called errors and omissions insurance) in order to get licensed in their state or work in a specific setting like a hospital.

Find business insurance requirements in your state

Classification codes

Insurance companies use a system of class codes for reference when determining the premiums for some policies. These codes group similar types of work together to give the insurer an idea of the level of risk your business faces.

- General liability class codes group businesses by their industry. Construction businesses face higher risks of injuries and property damage claims. Professional services and consultants are considered less risky for general liability claims, and have different class codes to represent this.

- Workers' compensation class codes sort employees by the type of work they do. Clerical office workers across different industries may share the same workers' comp code, which designates them as low risk for work-related injuries and illnesses.

Business property

The premiums of policies that cover property damage and theft primarily depend on the value of the insured property and its condition, such as inventory, equipment, and your building if you own it.

There are two different ways to insure your property:

- An actual cash value policy reimburses you for the item's current market value, which includes depreciation for how long it was used.

- A replacement value policy will pay for the full cost of a brand-new replacement item.

Insuring your business property for its replacement value costs more, but it'll also pay out more in the event of a claim.

Business income

Businesses that bring in more revenue are associated with a higher rate of claims, which is why they are charged more for insurance.

As your small business grows, so does your risk. You may need to increase your policy limits and boost your coverage to fully protect your business.

For example, a manufacturer might expand its factory by hiring more workers and buying expensive machinery. It would see a corresponding increase in its workers' comp rates and its property insurance costs, while gaining protection for its workforce and new property.

Number of employees

With more employees comes a higher rate of customer interactions, workplace injuries, and professional mistakes, which means an increase in your premiums. The size of your workforce affects almost every policy, from general liability to workers' comp, commercial auto, and E&O insurance.

A comprehensive workplace safety plan can reduce the rate of incidents and claims, which helps keep your premium low.

Here are some examples of how to protect your workers and avoid claims:

- Supply employees with gloves, goggles, or other protective gear

- Train employees in safe lifting techniques

- Have a clear procedure for injuries and emergencies

- Offer cybersecurity training for employees

- Document all interactions with clients and customers

- Avoid calling or texting drivers while they are on the road

Types of business insurance purchased

Different policies come with different costs, with general liability insurance being the most affordable policy. A business owner's policy is a cost-effective way of buying coverage, as it includes both general liability and commercial property insurance at a discount.

On the other hand, cyber insurance is one of the most expensive policies. Cyberattacks are both common and costly—which is why it's worth the expense.

Due to the high cost of medical bills and litigation, it's a similar case for car insurance. Commercial auto insurance costs more than personal auto insurance, as it typically has higher limits and covers multiple drivers and vehicles.

You can often bundle coverages purchased from the same insurer, which helps keep costs low when you need more than one type of insurance.

Business experience

Companies that have been in business for longer may see a reduction in their insurance rates. Insurance companies consider established businesses less risky, as they've had time to develop a system of best practices to avoid accidents and lawsuits.

For example, a tech company that has demonstrated stability over the years will pay less for insurance than a newly established startup that has unknown liabilities and no proven track record.

Business structure

Whether your business is classified as a sole proprietorship, limited liability company (LLC), or S corporation can determine how much coverage you need and your subsequent insurance costs.

For example, insurance is generally inexpensive for sole proprietors and single-person LLCs, who may need only minimal coverage for their business operations.

Larger LLCs and S corps will cost more to insure. They generally earn a higher revenue, have more workers, and take on bigger projects—all factors that increase the cost of insurance.

Occasionally, states might have specific insurance regulations for a type of business structure. For example, executive officers and directors of an LLC can sometimes choose to exempt themselves from workers' compensation coverage.

Business operations

Your business operations and their associated risks will also impact your premiums. That includes the processes, systems, and activities that are part of your day-to-day work.

Streamlining your business operations can improve your efficiency and reduce your risks, which can help keep your premium low.

Here are a few examples of potential improvements:

- A tree trimming business conducts a hazard assessment before starting any project.

- A clothing factory implements a strict protocol for the use of dangerous machinery.

- A software development company has a strict code review process.

Your insurance company may have a list of best practices and protective measures that you can implement to reduce your premiums. That might include cybersecurity controls, or security cameras and alarms. In some cases, loss control measures may be required in order to get insured.

Claims history

A history of claims will drive up your insurance rates, which is why risk management is essential. Even a single claim on your policy can result in a premium increase.

On the other hand, once you've been in business for several years and maintained a clean history of claims, you may see a decrease in your insurance rates.

Fortunately, there's a way to reduce the likelihood of a claim for every insurance policy. For general liability insurance, that might mean eliminating clutter that customers could trip over, or installing brighter lighting in a dim stairwell.

Similarly, security systems, sprinklers, and fire extinguishers can help prevent a property insurance claim like a burglary or a kitchen fire.

How can you get affordable business insurance?

Business insurance companies sell a variety of products at different rates, which is why it's important to compare their offerings. You could contact each individually—but it's faster and easier to rely on an insurance agent or broker, like Insureon.

Here's a breakdown of the best ways to save money on business insurance:

- Compare quotes. With Insureon, you can fill out our easy application to get quotes from top-rated insurance companies. A licensed insurance agent will help you find coverage that matches your risks, at a price you can afford.

- Customize your policies. You can opt for a higher deductible or lower coverage limits to save money on your premiums.

- Pay the annual premium. Insurance companies often offer a discount when you pay the full yearly amount instead of the monthly premium.

- Manage your risks. Installing a security system, providing equipment like goggles and gloves, and eliminating clutter can reduce your risk of accidents and lawsuits.

- Bundle policies. You can often bundle policies bought together from the same insurer at a discount.

Top insurance bundles

A business owner's policy is the most common cost-saving insurance bundle, but there are others as well:

- Professionals in some industries can buy general liability and professional liability insurance together.

- Tech companies often bundle errors and omissions and cyber insurance in a package called tech E&O.

- Designed for small and medium businesses with higher risks, a commercial package policy (CPP) bundles general liability and commercial property insurance.

- Management liability insurance bundles policies that protect a business's decision makers, such as directors and officers insurance (D&O) and employment practices liability insurance (EPLI).

How do you buy small business insurance with Insureon?

Insureon partners with top-rated U.S. insurance companies to find the right coverage for your small business. To get started, fill out our easy online application with basic information about your company, such as revenue and number of employees, and get free business insurance quotes from the nation's leading carriers.

You can consult with a licensed insurance agent at any point in the process. Compare quotes and choose the coverage that fits your business needs and your budget. Once you pay for your policy, you can download a certificate of insurance to show clients and others that your business is protected.

Obtén más información sobre precios de seguros para negocios (en español).

Our methodology

Insureon is the number one online marketplace for small business insurance, with a well-established history of finding insurance for niche professions. Over the years, we have helped everyone from software developers to house cleaners, management consultants, and general contractors with their business insurance needs.

We partner with 40+ leading insurance carriers, such as The Hartford, Liberty Mutual, and Acuity, to find the best possible coverage for your business. Our expert agents can guide you through your options and answer any questions along the way.

The average costs on this page were derived from our data on 40,000 small business owners who purchased policies through Insureon. To understand how your business compares to our typical customer, it's helpful to get an idea of who we insure. The majority of our small business customers have:

- One to four employees

- Annual revenue ranging from less than $50,000 to more than $200,000

- Five years or less in business

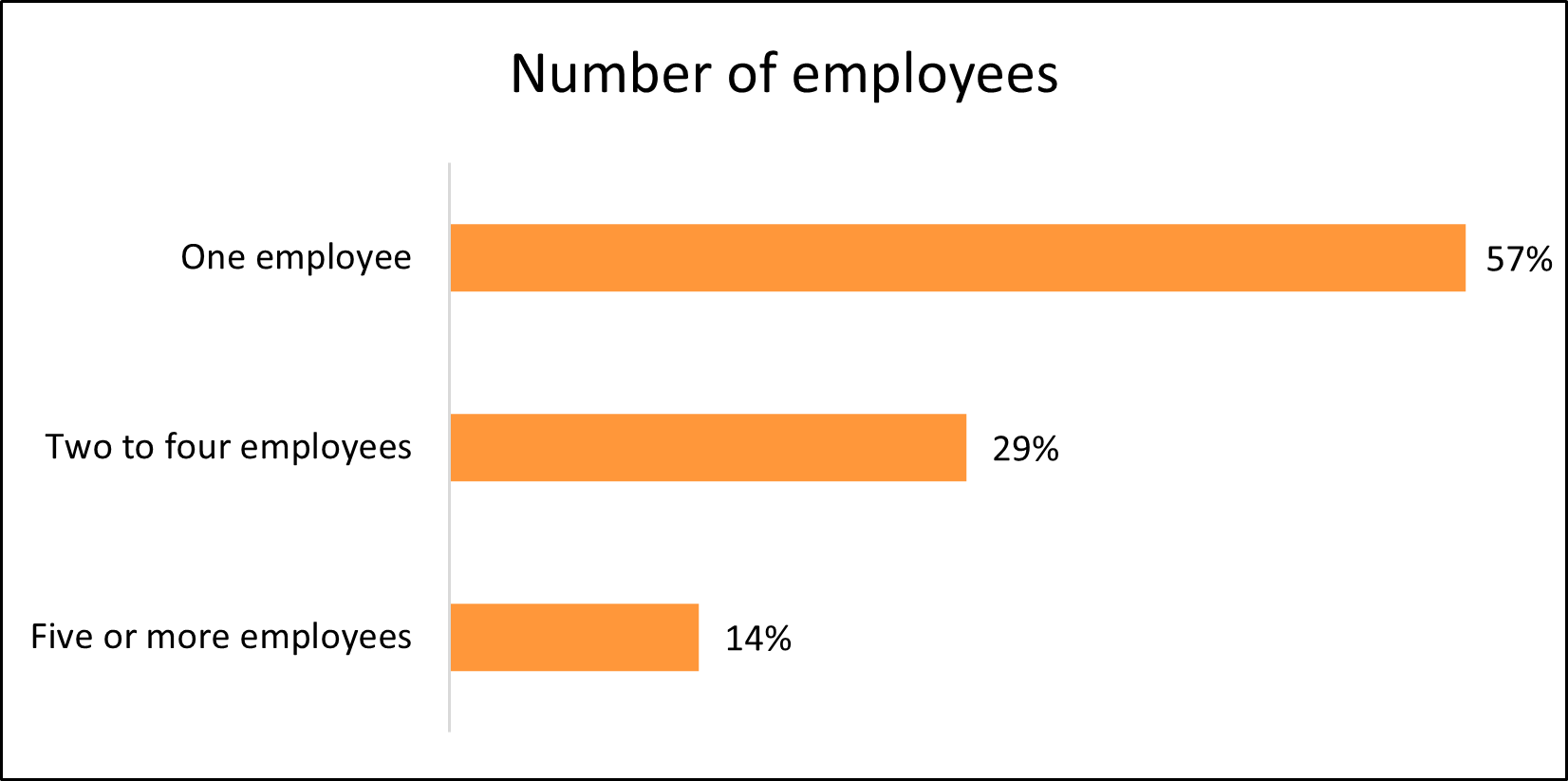

Most businesses have only one employee

The number of employees can impact the cost of business insurance coverage, especially for policies like workers' compensation insurance.

The majority of small businesses in this analysis (57%) have only one employee. That means most of our customers are sole proprietors, independent contractors, and freelancers. Another 29% of businesses have two to four employees, and others employ five or more.

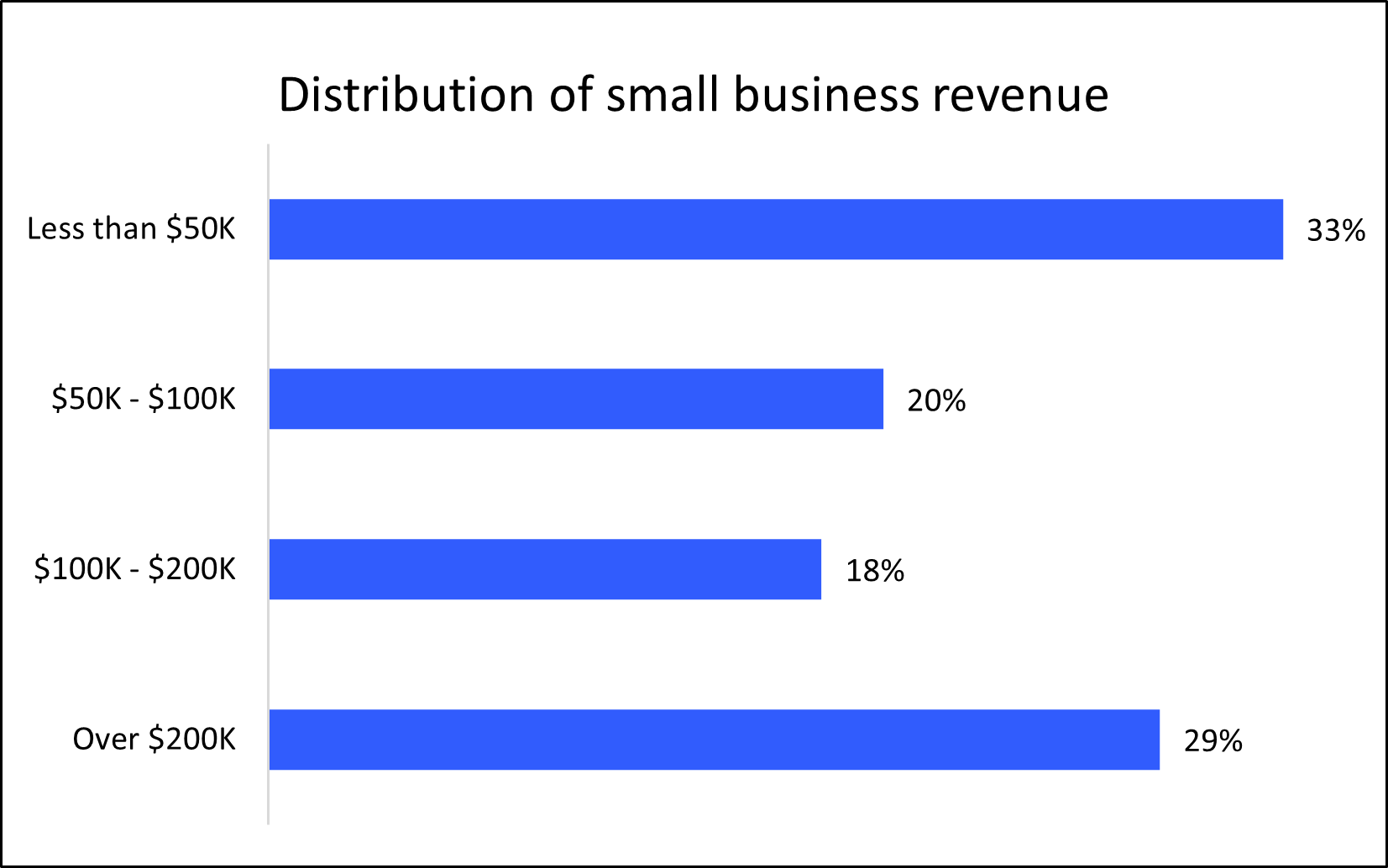

53% of businesses earn less than $100,000 annually

Your revenue also impacts the cost of small business insurance. For example, a small business that earns less than $1 million in annual revenue may be eligible for a cost-saving business owner's policy.

The average revenue of the small businesses included in this analysis is $80,000. The majority of customers (53%) have less than $100,000 in annual revenue.

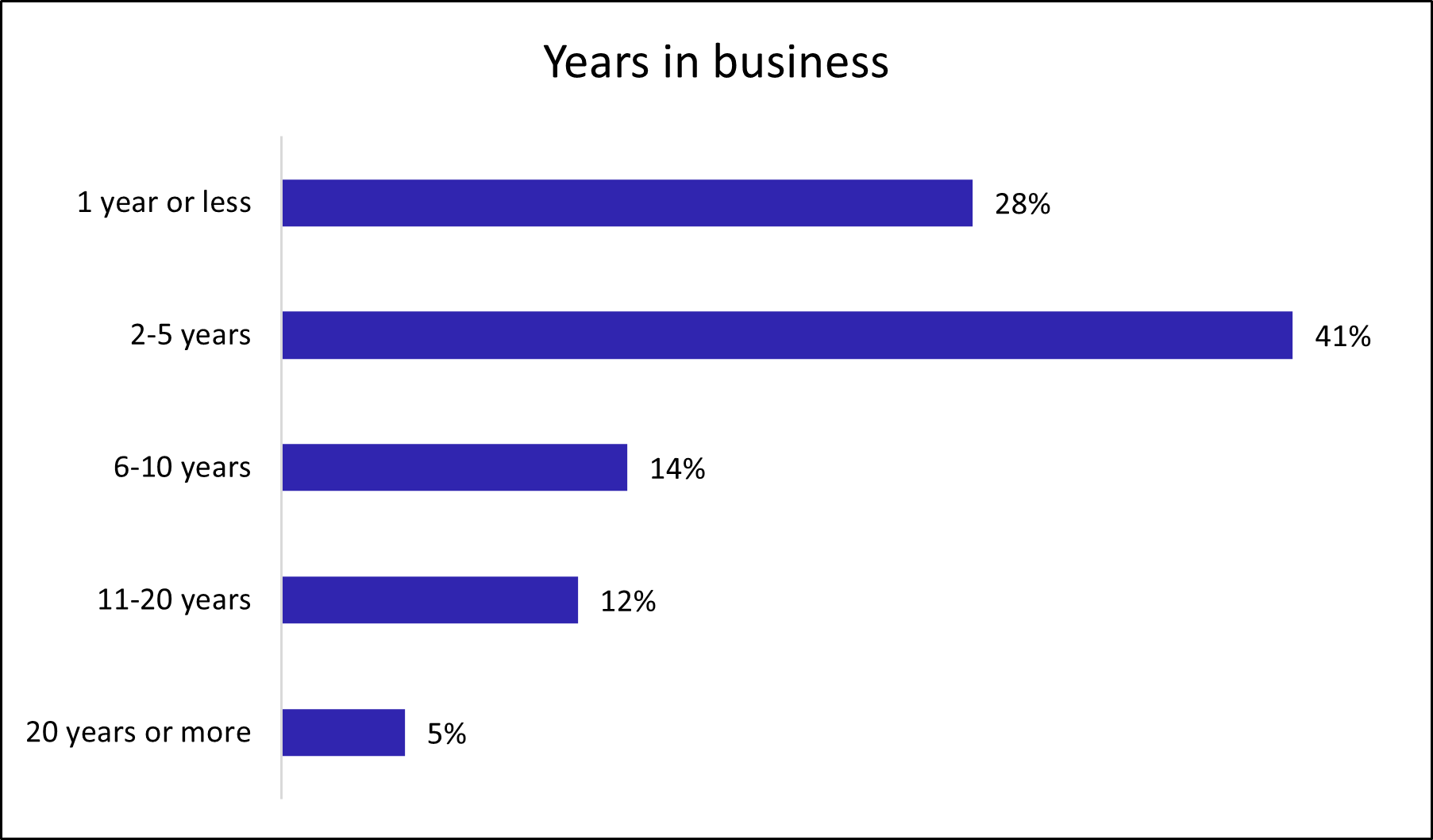

Most companies have been in business for five years or less

Business insurance premiums may be lower for companies that have been in business for many years without making a claim.

The majority of companies included in this analysis (69%) have been in business for five years or less.

Who uses our data?

Insureon is a trusted source of data on small business insurance costs for numerous outlets.

Publications whose articles include our data: CNBC, Forbes, NerdWallet, Business News Daily, and Money.com.

Other companies that rely on our data for reporting: PayPal, the U.S. Chamber of Commerce, Insurance.com, Investopedia, Shopify, SoFi, and LendingTree.

Learn more about business insurance costs

Want free expert advice right in your inbox?

By entering your email address and subscribing, you agree to our Terms of Use and Privacy Policy