Cheap professional liability insurance

How do I find cheap professional liability insurance?

Professional liability insurance, sometimes called errors and omissions insurance (E&O) or medical malpractice insurance, is a type of professional indemnity insurance for businesses that offer professional services and advice. It covers risk exposures such as negligence, misrepresentation, inaccurate advice, and violations of good faith.

If a client sues your business, claiming that your mistake or oversight cost them money, your professional liability policy would help with your legal defense costs. Professional liability can also cover claims that your work was late or never delivered.

Starting at $33 per month, a professional liability insurance policy can be affordable for small businesses.

There are many ways for you to keep costs low. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from trusted carriers.

In addition, bundling your professional liability policy with other insurance products, choosing cost-saving options on your professional liability insurance coverage, and managing your risks to avoid insurance claims can also help you pay less.

Table of contents

1. Shop around and compare quotes from carriers

Getting quotes from multiple insurance companies is one of the best ways to find affordable professional liability insurance coverage. You could go straight to the source and contact each carrier directly, or you could work with a digital insurance agency like Insureon for a simpler and easier experience.

At Insureon, you can get professional liability insurance quotes from top-rated providers, such as The Hartford and Chubb, with a single online application. Our licensed insurance agents are available to help you customize a policy for your business's unique needs, making sure you meet state laws and your profession's requirements.

Once you select the professional liability insurance policy you need, you can get coverage and a certificate of insurance (COI) in less than 24 hours.

Find cheap professional liability insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month. Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now! Insureon. Protection is peace of mind.

How much does professional liability insurance cost?

The average cost of professional liability insurance for Insureon's customers is $61 per month.

Professional liability insurance premiums are calculated based on a few factors, including:

- Industry and type of business

- Your policy’s coverage limits and deductible

- Number of employees

- Claims history

2. Bundle professional liability with other policies

Depending on your profession, you might be able to bundle professional liability insurance with cyber insurance in a bundle called technology professional liability insurance.

Within the technology field, this bundle is commonly referred to as technology errors and omissions insurance, or tech E&O. This policy protects IT consultants and other tech professionals from lawsuits related to mistakes, including poor advice that leads to a data breach at a client's business.

In addition, some businesses are able to bundle their professional liability policy with their general liability coverage.

Combining coverages is typically less expensive than buying each policy separately.

Top professions that need professional liability insurance

Don't see your profession? Don't worry. We insure most businesses.

3. Customize your professional liability policy

Choose lower policy limits

One easy way to save money on professional liability insurance is by choosing lower per-occurrence limits and aggregate limits for your policy. However, there's a tradeoff.

The policy limit is the maximum your insurer will pay out on a claim. If your business gets hit with an expensive lawsuit, you could end up paying thousands of dollars in legal fees if you don't have sufficient coverage.

When choosing limits, you'll want to consider both the cost of your premium and the cost of a potential lawsuit against your business.

Select a higher deductible

Your deductible is the out-of-pocket amount you have to pay before your insurer will cover a claim. If your deductible is $2,000 and you have a $25,000 claim, you would first have to pay $2,000 and then your insurance company would pay $23,000.

Keep in mind that while choosing a higher deductible can reduce your premium, your business might end up paying more in the long term if you face a couple of expensive claims. And if a claim doesn't meet your deductible, you'll have to pay the entire amount yourself.

On the other hand, if you think it’s unlikely you’d face a professional liability claim, a higher deductible might benefit your business. You'd pay less for insurance, yet still have the professional liability coverage you need.

Pay your premium annually

Insurance companies typically offer discounts if you pay your entire premium once a year, rather than monthly. Make sure to opt for annual payments if you can afford it, as you'll save money in the long run.

Maintain continuous coverage

It might be tempting to start and stop your professional liability coverage as needed, such as for the duration of a large project. However, that strategy doesn't work with a professional liability insurance policy.

First, professional liability is a claims-made policy, which means you're only insured for claims filed while your policy is active. If someone sues your business after a project's completion, you could face expensive legal bills if you let your coverage lapse.

If you need coverage for work you've done in the past, make sure to set your policy's retroactive date to cover that time period.

In addition to this, insurance providers charge more when you stop and restart coverage. Maintaining continuous coverage guarantees you're protected when you need it, and also helps keep your premium low.

4. Manage your risks to keep your premium low

A professional liability claim can result in an increase in your premium, especially if you have multiple claims or one that’s unusually expensive. That's why avoiding lawsuits is crucial to paying less for this policy.

Professional liability lawsuits typically arise over disagreements between a business and its customers. You can reduce your risk of this happening by communicating openly with customers. Let them know in advance if you expect any problems or delays, and give them a heads-up when you run into an issue that might impact your ability to deliver.

It helps to have detailed contracts that stipulate what services you provide, when you’ll provide them, and how both parties will communicate. Make sure to get every communication in writing, and have clients sign off on any changes.

By keeping your customers satisfied and fully aware of what you’re up to, they'll be far less likely to file a lawsuit.

Cheapest states to purchase professional liability insurance

| State | Professional liability |

|---|---|

$49 per month | |

$51 per month | |

$52 per month | |

$56 per month | |

$56 per month | |

$56 per month | |

$58 per month | |

$59 per month | |

$59 per month | |

$62 per month |

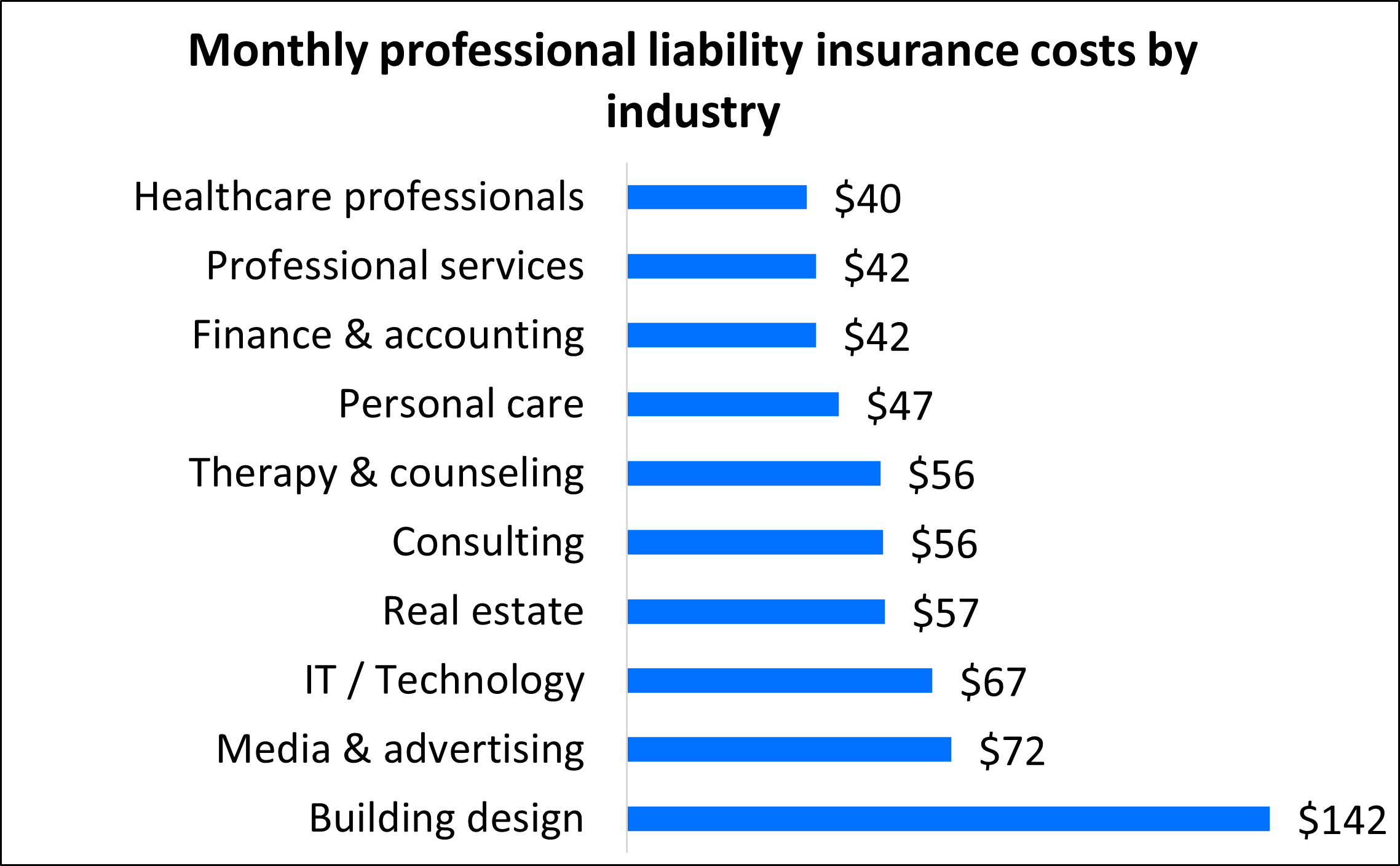

Cheapest industries to purchase professional liability insurance

In addition to your location, your industry can affect how much you pay for professional liability insurance. Generally speaking, industries that face greater consequences if a mistake or negligence occurs can expect to pay a higher premium.

For example, an architect who is responsible for building a new high rise will likely pay more for their professional liability insurance coverage than a photographer who takes family pictures.

Among Insureon policyholders, industries such as professional services, finance and accounting, and personal care tend to pay less compared to higher risk industries like building design and media and advertising.

Here's a look at professional liability insurance costs for different types of business professions:

What doesn’t professional liability insurance cover?

While professional liability insurance should be an important part of your risk management plan, it doesn’t protect you from every business risk.

Other types of small business insurance you may need include:

General liability insurance: This is typically the first liability policy new business owners buy. It protects against financial losses from customer bodily injuries, damage to a customer’s property, and advertising injuries.

Business owner’s policy (BOP): A BOP bundles general liability coverage with commercial property insurance to protect against common claims and property damage. It generally costs less than buying these two policies separately.

Workers’ compensation insurance: Workers' comp is required in almost every state for businesses with employees. It covers medical expenses for work-related injuries and illnesses, which are not typically covered by personal healthcare insurance.

Commercial auto insurance: This coverage is required in most states for businesses that own vehicles. It can cover your vehicles in the event of an accident, theft, weather damage, or vandalism.

Cyber insurance: Cyber insurance helps small businesses recover financially after a data breach or cyberattack. It's recommended for any business that stores personal information, such as credit card numbers or email addresses.

Get affordable professional liability insurance with Insureon

Complete Insureon’s easy online application today to find affordable professional liability insurance from top-rated U.S. companies. You can also consult with an insurance agent on your coverage options, including how to find affordable general liability and commercial auto insurance.

Once you find the right policy for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours, offering peace of mind almost instantly.