Nurse insurance in California

Learn about business insurance requirements and the most common policies for nurses in California.

Which policies are required for nurses in California?

Whether you're a registered nurse (RN), nurse practitioner (NP), or licensed practical nurse (LPN), contracts and state laws may require you to carry certain types of insurance.

If you have a commercial lease, your property manager may require you to purchase general liability insurance. Commonly purchased by nurses in California, general liability insurance can protect your business from expenses associated with common mishaps, such as client property damage and injuries.

State law in California requires every small business that has employees to provide workers’ compensation insurance, which covers medical bills for work injuries. This policy is also recommended for sole proprietors and independent contractors, as health insurance can deny claims for injuries related to your job.

If your business owns a vehicle, you're required to carry commercial auto insurance. This policy helps cover medical bills and property damage if your business vehicle is involved in an accident.

Top nursing professionals we insure

Don't see your profession? Don't worry. We insure most businesses.

What are the most common insurance policies for nurses in California?

Nurses in California most often buy the following types of insurance. Which policies you need depends on the specifics of your business, such as the number of employees, ownership of a business vehicle, and the terms of any leases or contracts.

General liability insurance

General liability insurance is the foundation of a nurse’s business protection, with coverage that extends to client injuries, client property damage, and advertising injuries. Most commercial leases require you to have this coverage.

Business owner's policy

Nurses in Los Angeles, San Diego, San Jose, and elsewhere in the state sometimes qualify for a business owner’s policy (BOP). This package helps your business save money by bundling commercial property insurance with general liability coverage at an affordable rate.

Workers' compensation insurance

Businesses in California that hire employees are required to carry workers’ compensation coverage. If you are a sole proprietor, the coverage is optional. However, if you slip and break an arm in your office, or injure your back lifting a patient, you can turn to your workers’ comp policy to help pay your medical bills and lost wages.

Professional liability / medical malpractice insurance

Professional liability insurance for nurses protects against claims that your work caused harm. That could include accidentally administering the wrong medication, or a baseless claim that you mistreated a patient. This coverage is sometimes referred to as malpractice insurance.

Commercial auto insurance

State law requires commercial auto insurance for business vehicles used to transport people or merchandise. Business and personal vehicles must comply with California's auto liability insurance requirements:

- $15,000 in bodily injury liability or death liability per person

- $30,000 in bodily injury liability or death liability to more than one person

- $5,000 in property damage per accident

This policy helps cover the costs of injuries and property damage in an accident involving a work vehicle.

Cyber liability insurance

Nurses handle sensitive patient information on a daily basis, which is why cyber liability insurance is so important for this profession. This policy helps cover the costs of data breach notifications, fraud monitoring services, and other necessary responses to a data breach or cyberattack.

Any professional who handles sensitive patient information should invest in cyber liability insurance and become familiar with California's data breach notification laws.

How much does business insurance cost for California nurses?

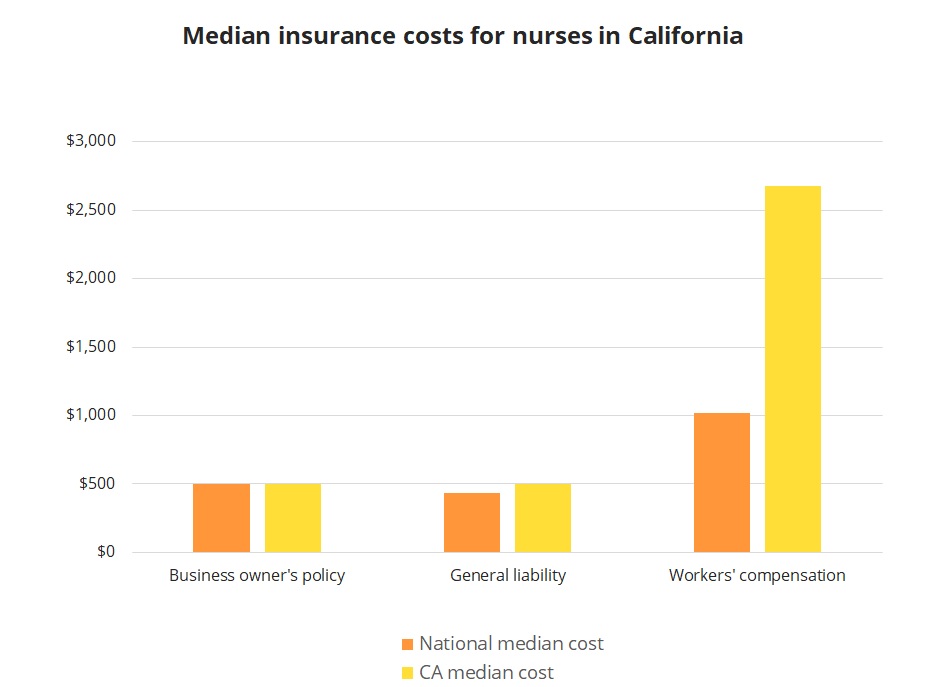

According to an analysis of Insureon applications, the typical nurse in California can expect to pay the same as the national median for some policies, but significantly more for others.

The median annual cost of a business owner’s policy for a nurse in the state is $500, exactly the same as the national median.

Nurses in California pay a median of $2,675 for workers' compensation coverage, which is more than double the national median.

Save time and money with Insureon

Insureon’s industry-leading technology helps nurses in California save time and money shopping for insurance by comparing policies from top U.S. carriers. Start a free online application to review quotes for the policies that best fit your business. Our insurance agents are licensed in California and can answer your questions as you consider coverage.

To make the application go quicker, have this information ready:

- Workforce details, such as the number and types of employees

- Current and projected revenue

- Business partnerships

- Insurance history and prior claims

- Commercial lease insurance requirements

Apply for free insurance quotes for nurses today.