General contractor insurance in Michigan

Learn about business insurance requirements and the most common policies for general contractors in Michigan.

Which policies are required for general contractors in Michigan?

Depending on the specifics of your work, general contractors may be required to hold several different types of business insurance. For example, if your business owns a vehicle, you likely need to purchase commercial auto insurance to meet state requirements.

If you have a physical location with a commercial lease, your property manager may require you to purchase general liability insurance. Commonly purchased by general contractors in Michigan, general liability insurance can protect your business from expenses associated with common mishaps, such as customer property damage and injuries.

To meet state requirements in Michigan, general contractors with employees must provide workers’ compensation insurance, which covers lost wages and medical bills for work injuries.

Depending on your clients and the type of work you do, you may also need builder’s risk insurance or surety bonds.

What are the most common policies for general contractors in Michigan?

General contractors may need different types of insurance depending on the work they do and their client contracts. In Michigan, general contractors often buy these policies.

General liability insurance

General liability insurance is the foundation of a general contractor’s protection. It covers damage to client property, as well as client injuries. Most commercial leases require you to have this coverage.

Adding commercial umbrella insurance can boost your coverage on general liability insurance and other policies.

Business owner's policy

General contractors who work independently or own a small company often qualify for a business owner’s policy (BOP). This policy bundles general liability coverage and commercial property insurance together at a discount.

A BOP is the top policy recommended by Insureon's expert agents, as it offers protection against common liability claims and business property coverage at an affordable price.

Workers' compensation insurance

If you own a construction or home improvement business in Michigan that has at least three employees or at least one employee who works a minimum of 35 hours a week for 13 weeks per year, your business is required to carry workers’ compensation insurance.

Workers’ compensation can help pay for medical bills and lost wages when an employee is injured on the job.

Commercial auto insurance

Commercial auto insurance protects vehicles owned by your general contracting company. It covers property damage and medical bills in an accident, along with vehicle theft, weather damage, and vandalism.

Contractor’s tools and equipment insurance

Contractor’s tools and equipment insurance protects a general contractor’s saws, nail guns, drills, and other construction equipment. Look to this policy or inland marine insurance to protect equipment that moves from place to place.

Professional liability insurance

Professional liability insurance provides protection when a general contractor is sued for a professional mistake, such as missing a deadline on a construction project. This policy is also called errors and omissions insurance (E&O).

Contractor surety bonds

Surety bonds guarantee reimbursement for the client if a general contractor is unable to fulfill the terms of a contract. Common types of surety bonds include bid bonds, performance bonds, and payment bonds.

Builder’s risk insurance

Builder’s risk insurance can cover fires, vandalism, equipment theft, and other damage done to a structure still under construction.

How much does business insurance cost for general contractors in Michigan?

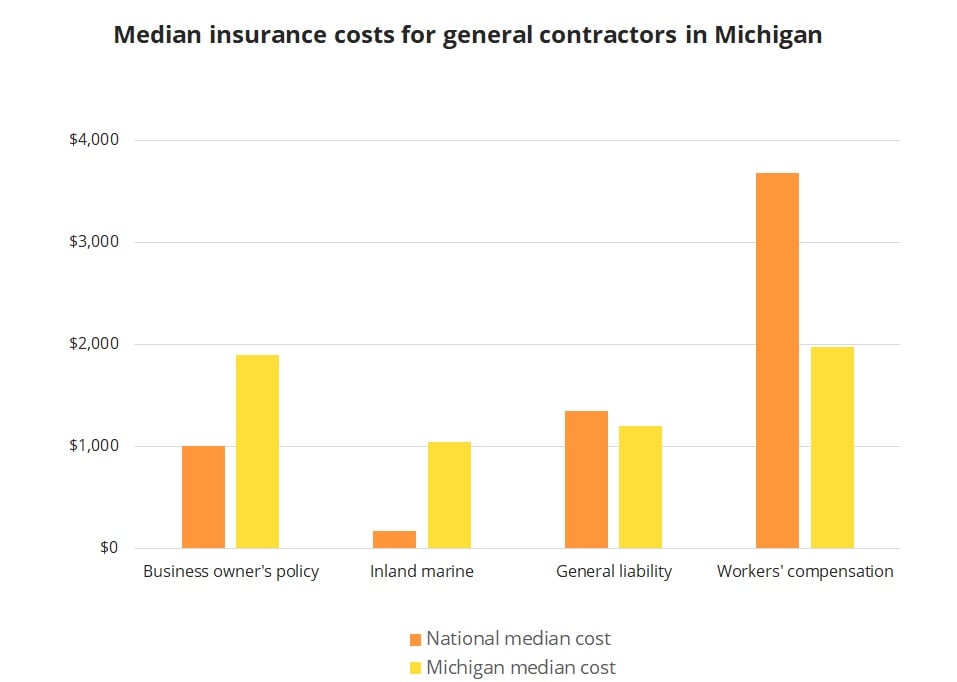

According to an analysis of Insureon applications, the typical general contractor in Michigan can expect to pay more than the national median for some types of business insurance, and less for others.

For example, the median annual cost of a business owner's policy for general contractors in Michigan is $1,900, more than the national median of $1,000.

On the other hand, the median annual premium for workers’ comp is $1,974, significantly less than the national median of $3,682.

Save time and money with Insureon

Insureon’s industry-leading technology helps general contractors in Michigan save time and money shopping for insurance by comparing policies from top U.S. providers.

Start a free online application to review quotes for the policies that best fit your business. Our insurance agents are licensed in Michigan and can answer your questions as you consider coverage.

To make the application go quicker, have this information ready:

- Workforce details, such as the number and types of employees

- Current and projected revenue

- Business partnerships

- Insurance history and prior claims

- Commercial lease insurance requirements

Apply for free insurance quotes for general contractors today.