Professional liability insurance cost

The cost of professional liability insurance, also called errors and omissions insurance (E&O), varies based on a number of factors about your business. Your premium is directly impacted by the type of work you do, industry risk, and more.

What is the average cost of professional liability insurance?

Small businesses pay an average premium of $61 per month, or about $735 annually, for professional liability insurance.

Our figures are sourced from the median cost of policies purchased by Insureon customers from leading insurance companies. The median offers a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Get professional liability insurance to protect yourself from claims that you didn't deliver on a deadline, or made a costly mistake.

Some clients require you to have this policy. It can protect you from expensive lawsuits for only about 60 dollars per month.

Don't put your business at risk. Apply for your policy today!

Alert. Alert.

Typical professional liability insurance premiums for Insureon customers

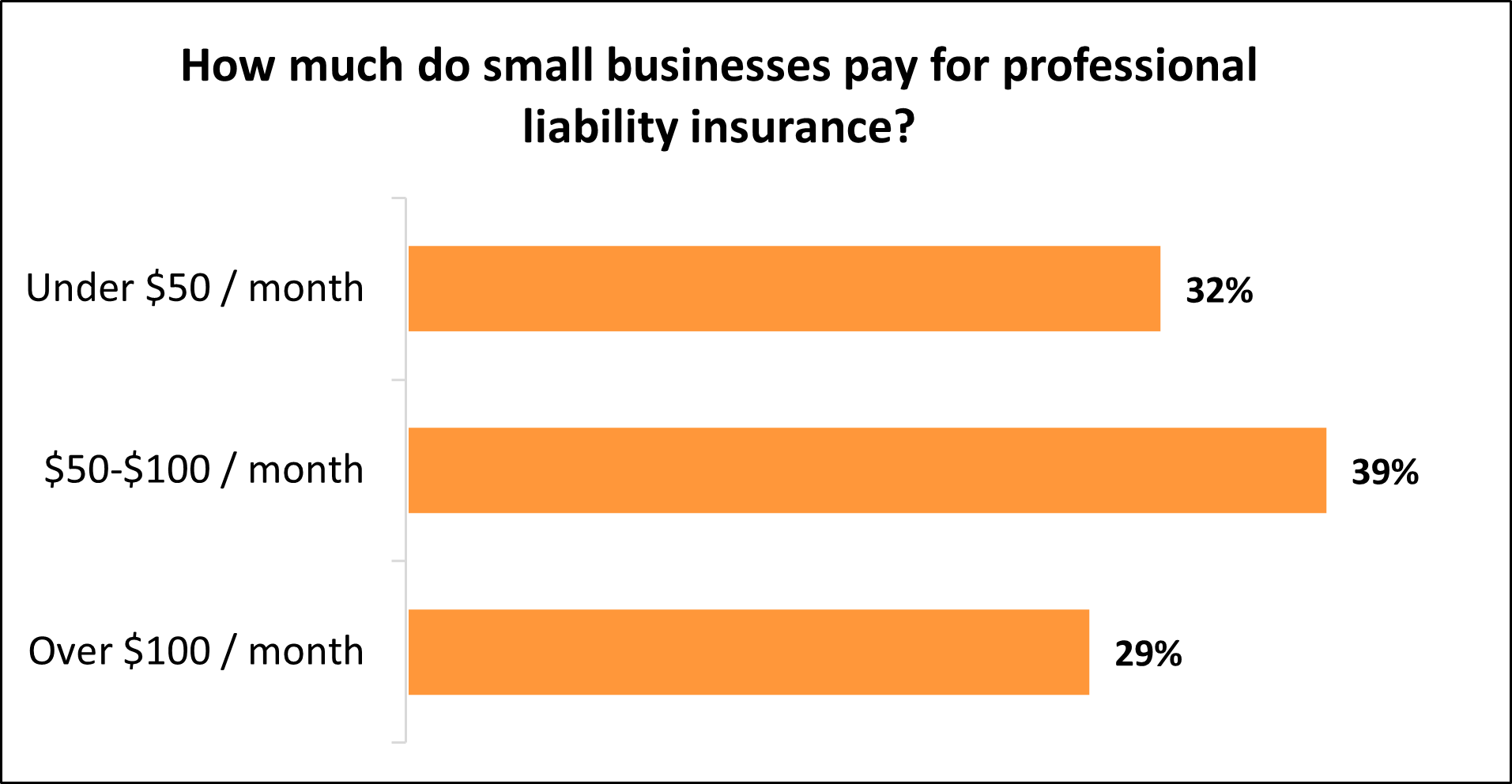

While Insureon's small business customers pay an average of $61 monthly for professional liability insurance, 32% pay less than $50 per month for their policies, and another 39% pay between $50 and $100.

The cost varies for small businesses depending on their risks and the coverage they choose.

Understanding professional liability insurance cost factors

How do policy limits affect professional liability insurance costs?

If you want a professional liability insurance policy that covers more expensive lawsuits, you’ll need to increase your coverage limits – which means you’ll pay a higher premium to your insurance company.

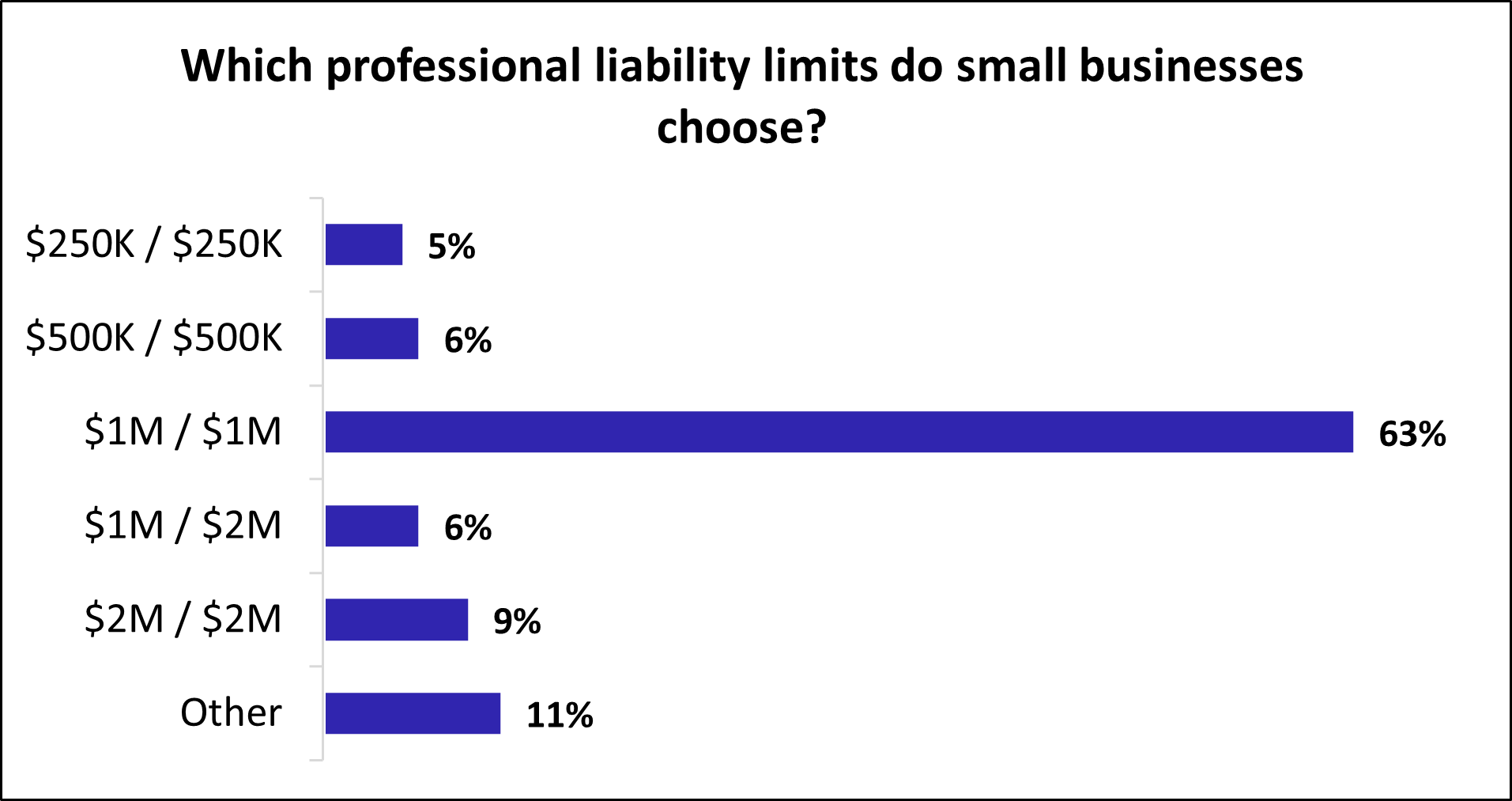

The limits on professional liability coverage vary significantly, from $250,000 to $2 million. Professional liability insurance coverage with $1 million / $1 million limits is the most popular option for small businesses. This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

- $1 million aggregate limit. During the lifetime of the policy, the insurer will pay up to $1 million to cover claims.

The majority of Insureon customers (63%) choose a professional liability policy with $1 million / $1 million limits. Nine percent of our customers choose a policy with $2 million / $2 million limits, the next most popular choice.

When buying a policy, you can choose a higher deductible to save money. However, if you can’t pay the deductible, your insurance won’t activate to cover your claim. The average deductible that Insureon customers select for professional liability insurance is $2,500.

The right amount of coverage depends on your business needs. You want coverage that'll cover a potential lawsuit, without buying more than you need. Chat with a licensed insurance agent if you're unsure which limits are right for your business.

How does your industry impact the cost of professional liability insurance?

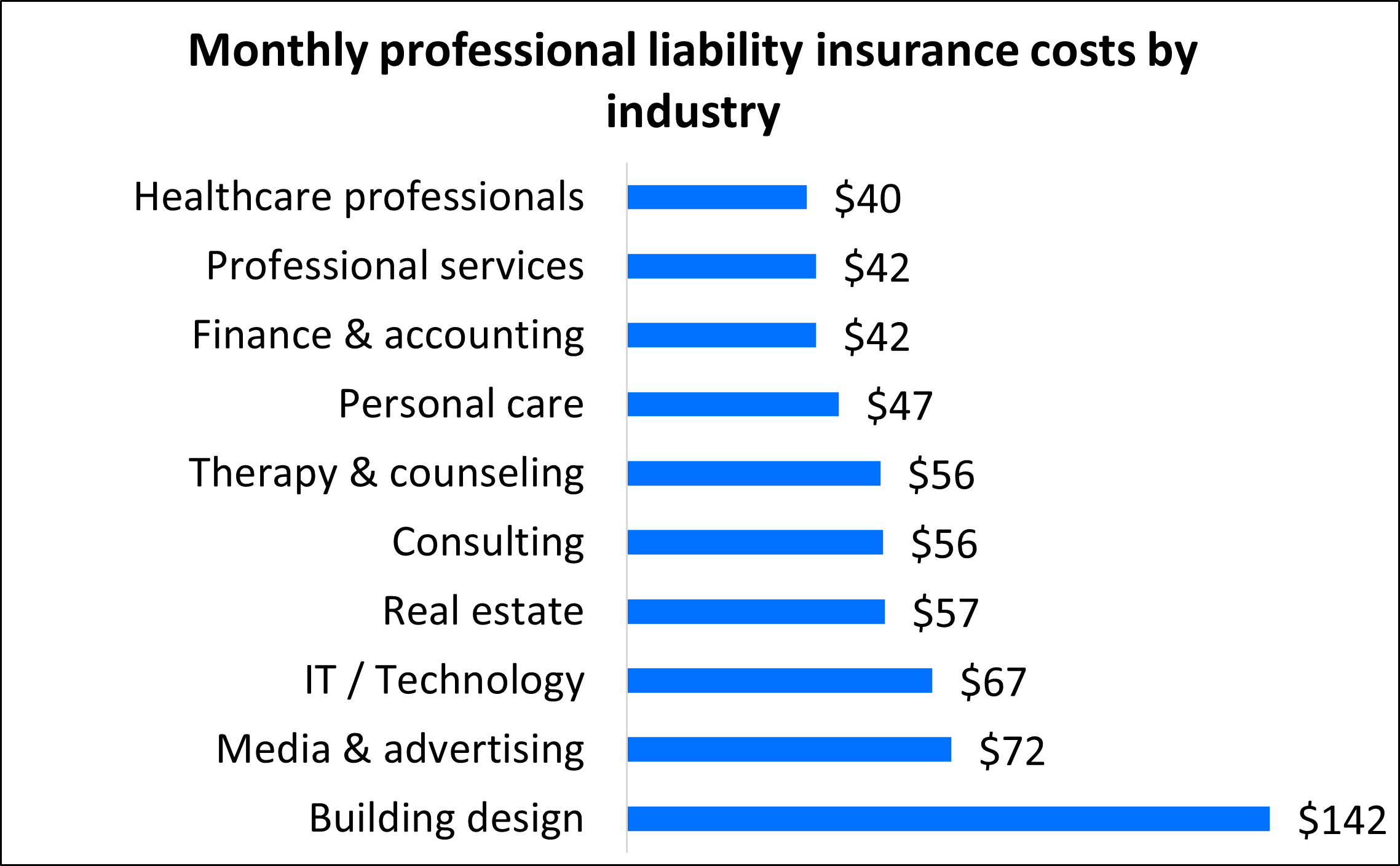

Our analysis of professional liability insurance costs reveals that for small businesses, your industry has the biggest impact on your premium. Generally, insurance companies charge higher risk industries higher premiums, while lower risk industries enjoy lower rates.

For example, building design professionals, such as architects and engineers, are exposed to more risk than photographers or accountants. A mistake could lead to problems with the stability of a building, or cause an injury if a structure collapses.

Depending on your state and your profession, you may need professional liability insurance to get licensed or to work in your field. That can include real estate agents, insurance agents, lawyers, and doctors.

The graph below illustrates how the type of business affects what you'll pay for a professional liability insurance policy.

Top industries we insure

Don't see your industry? Don't worry. We insure most businesses.

Professional liability insurance provides affordable, necessary protection for professional services

Professional liability insurance is a must-have for small businesses that provide expert advice or services, such as IT consultants or professional services. You may see it referred to as errors and omissions (E&O insurance), professional indemnity insurance, or malpractice insurance depending on the industry.

Experienced professionals can still make mistakes or oversights, or give advice that causes financial loss for a client. If the client sues, legal costs can escalate to the point where they could sink your business.

Even if you've done nothing wrong, you're not immune to lawsuits. For example, your business could lose a key individual who you need to complete a project on time, or a client could sue over a budget overrun that was out of your hands.

When someone sues your business – even if it's a frivolous lawsuit – you'll have to pay legal defense costs, such as the cost of hiring an attorney. If you lose the suit, you could end up paying a fortune in a court-ordered judgment or a settlement.

A professional liability policy covers all of these costs, which could save your business from bankruptcy. Because the premium is based upon your level of risk and your industry, many small businesses pay only a small monthly premium for this type of insurance.

How can you save money on professional liability insurance?

It's possible to reduce your professional liability premium through a few simple steps:

Shop around. Insurance companies offer a range of professional liability premiums and coverages. Compare quotes from different carriers with Insureon's easy online application.

Pay your entire premium upfront. Policyholders can choose to pay insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run. Insurers often offer discounts to businesses that pay an annual premium.

Bundle policies. Depending on your industry, it's sometimes possible to bundle professional liability insurance with another policy, such as general liability insurance. An insurance bundle often costs less than purchasing each policy separately.

Keep continuous coverage. Continuous coverage is key if you don't want to pay out of pocket for professional liability lawsuits. While it’s possible to purchase coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire for professional liability and other claims-made policies. To file a claim, your insurance must be active:

- When an alleged mistake occurs

- When the claim is filed

Reduce your risks. Your professional liability claims history is a big factor when calculating your premium, which is why it's important to avoid lawsuits in the first place. Many professional liability lawsuits stem from client disputes. To reduce the risk of a lawsuit, you can:

- Strive to meet the standard of care for your industry

- Communicate clearly, especially when an issue arises

- Document all contracts and communications with clients

Why do small business owners choose Insureon?

Insureon is the #1 independent agency for online delivery of small business insurance. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online. By completing Insureon’s easy online application today, you can get free quotes for professional liability insurance and other business insurance policies from top-rated U.S. insurance companies.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. See our small business insurance cost overview or explore costs for a specific type of coverage.