Cheap errors and omissions (E&O) insurance

Your small business can save money on errors and omissions insurance by avoiding claims and choosing a higher deductible, among other methods. Learn how you can pay less on E&O and still get the protection you need.

How do I find cheap errors and omissions (E&O) insurance?

Errors and omissions insurance (E&O), also known as professional liability insurance or malpractice insurance, is an important policy for small businesses that give professional advice or provide professional services to clients.

E&O coverage protects your business from financial loss in the event that a client claims your mistake or oversight cost them money. This includes paying for defense costs and other legal fees.

Starting at $33 per month, errors and omissions insurance can be affordable for small businesses.

There are many ways for you to keep costs low. For example, you can compare rates from different insurance companies, such as through Insureon's easy online application that retrieves quotes from trusted carriers.

In addition, bundling your E&O policy with other insurance products, selecting cost-saving options on your errors and omissions insurance coverage, and keeping your claims history clean can also help you pay less.

Table of contents

1. Shop around and compare quotes from multiple insurance carriers

Different insurance companies will offer different prices for errors and omissions insurance. Some may even specialize in serving your industry and offer more affordable policies with tailored protection.

You could reach out to insurance companies directly and ask for quotes on their errors and omissions policies. Thankfully, there’s an easier method.

You can work with a digital insurance agency—like Insureon—to get errors and omissions quotes from top-rated providers, such as The Hartford and Chubb, with a single online application.

Insureon's licensed insurance agents can help you navigate different coverage options to find an affordable E&O policy that meets all your needs. Plus, they can ensure the policy you purchase provides the coverage you need to fulfill contracts, meet legal requirements, or reduce risks common to your profession.

You can begin coverage and get a certificate of insurance on the same day.

Find cheap errors and omissions insurance with Insureon

You know you need insurance for your small business, but where to start? And how can you keep costs down?

Insureon is here for you. You can get customized quotes from top carriers.

Most small businesses start with a general liability policy. You can combine property coverage with your liability insurance at a discount of $57 per month.

Maintaining a safe work environment can help you manage risk and lower your insurance costs too.

Get affordable insurance from the best carriers. Start your application now!

Insureon. Protection is peace of mind.

How much does errors and omissions insurance cost?

The average cost of errors and omissions insurance for Insureon's customers is $61 per month.

Your cost is based on several factors, including:

- Coverage limits

- Claims history

- Industry risk factors

- Business size

- Day-to-day operations

- Number of employees

2. Bundle your E&O insurance with other policies, when possible

Insurance companies often give discounts when you bundle multiple policies together. This includes your errors and omissions policy.

Tech and IT companies can often combine their E&O coverage and cyber insurance in a bundle called technology errors and omissions insurance, or tech E&O.

A tech E&O policy provides liability coverage related to:

- Oversights and mistakes

- Failure to deliver promised IT services

- Accusations of professional negligence

- Third-party cyber insurance (data breach lawsuits)

- Intellectual property and media liability (for certain professions)

Learn more about the types of claims tech E&O insurance covers.

3. Customize your E&O policy to reduce costs in the long-term

Choosing higher deductibles

A deductible is the amount of money you must pay toward a claim before your insurance benefits kick in. Say an E&O lawsuit costs a total of $50,000 and your deductible is $5,000. The insurance policy will cover $45,000, after you have paid the $5,000 deductible.

When it comes time to choose an insurance policy, the deductible should be an important factor in your decision. In general, higher deductibles mean lower premiums. The trade-off is that in the event of a claim, your business is responsible for paying a larger share up front.

A higher deductible might be worth it if you're mostly concerned about unlikely but very expensive claims.

If a claim does occur, the amount you pay towards the deductible might be insignificant compared to what the insurance policy covers. On the other hand, smaller losses that are less than your deductible may not be covered at all under the policy.

Paying your entire premium upfront

You can choose to pay your insurance premiums once a year rather than on a monthly billing cycle. While making a smaller payment each month requires less money upfront, it often costs more since insurers often offer discounts to businesses that pay an annual premium.

Keeping continuous coverage

While it’s possible to purchase omissions coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire.

To collect insurance benefits, your “claims-made” E&O policy must be active:

- When an alleged mistake occurs

- When the claim is filed

In short, continuous coverage is key if you don't want to pay out of pocket for E&O lawsuits.

4. Keep your claims history clean

As with auto insurance, a claim on your E&O policy can cause your premium to go up. Insurance companies may also be reluctant to insure a business with a lengthy record of claims, unless that business is willing to pay more.

Fortunately, you can take steps to reduce the likelihood of an E&O claim. Errors and omissions claims often arise from disagreements with clients. Clear communication, detailed contracts, and other measures can help you and your clients stay on the same track.

By keeping your claims history clean, you will reduce your losses. Having direct and straightforward conversations with clients, while also maintaining other controls, can help prevent potential losses.

Cheapest states to purchase errors and omissions insurance

| State | E&O insurance |

|---|---|

$49 per month | |

$51 per month | |

$52 per month | |

$56 per month | |

$56 per month | |

$56 per month | |

$58 per month | |

$59 per month | |

$59 per month | |

$62 per month |

Cheapest industries to purchase errors and omissions insurance

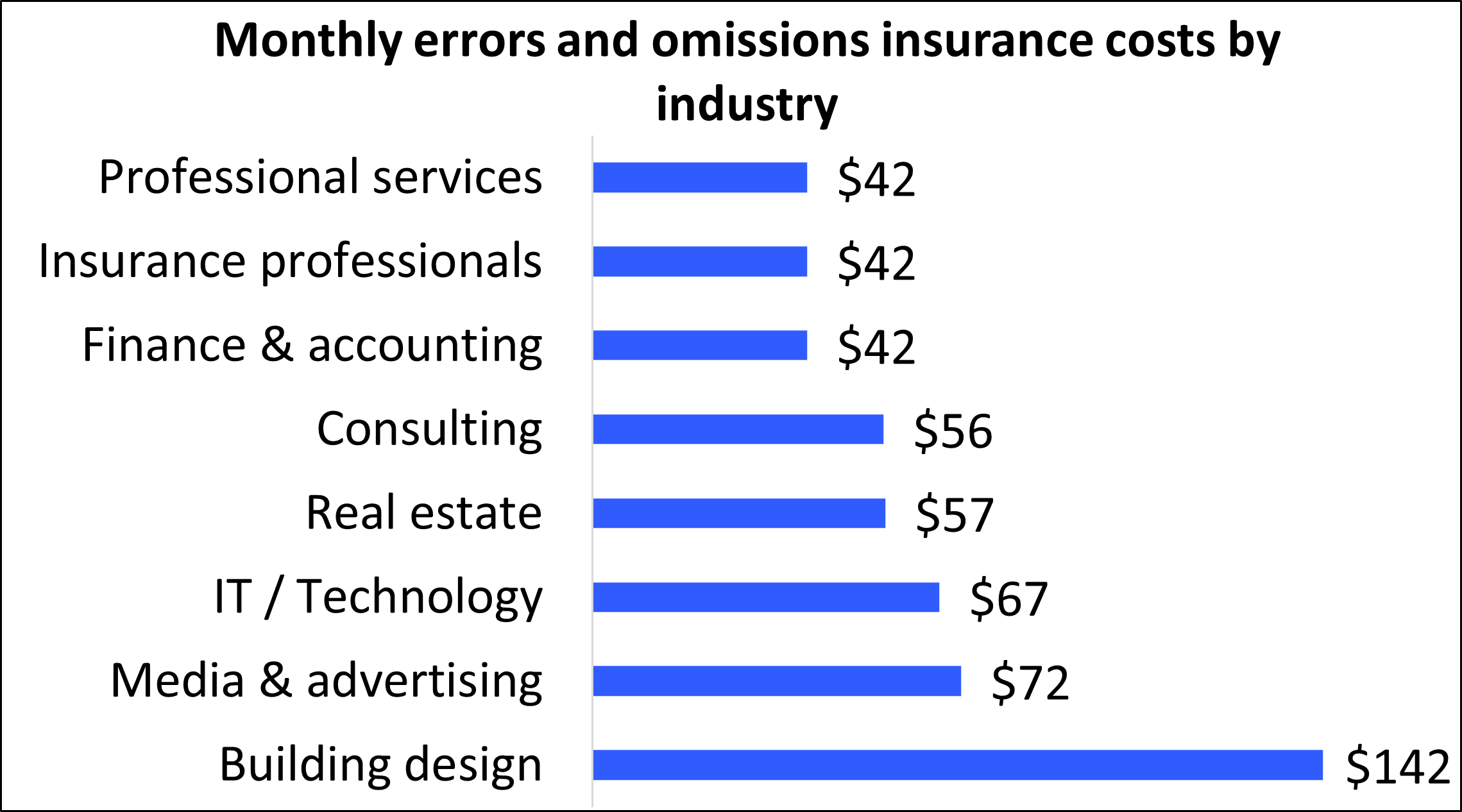

In addition to your location, your industry can affect how much you pay for an E&O insurance policy. Generally speaking, industries that face greater consequences if a mistake or negligence occurs can expect to pay a higher premium.

For example, an architect who is responsible for building a new high rise will likely pay more for their errors and omissions insurance coverage than a photographer who takes family pictures.

Among Insureon policyholders, industries such as professional services, insurance, and finance and accounting tend to pay less compared to higher risk industries like building design and media and advertising.

Here's a look at errors and omissions insurance costs for different types of business professions:

What doesn't errors and omissions insurance cover?

While errors and omissions insurance covers court costs and other legal fees over a client lawsuit related to unsatisfactory work, it does not provide complete protection.

Other insurance products to consider include:

General liability insurance: A general liability policy covers common business risks like customer bodily injury, damage to a customer’s property, and advertising injury.

Commercial auto insurance: This policy covers vehicles owned by your business and is required in nearly every state. It typically pays for accidents and damages related to theft, weather, and vandalism.

Workers’ compensation insurance: Workers' comp is required in almost every state for businesses that have employees. It can cover medical expenses for work injuries, which are not often covered by regular health insurance.

Business owner’s policy (BOP): A business owner's policy bundles general liability insurance with commercial property insurance to protect against liability claims and property damage. It generally costs less than buying these two policies separately.

Employment practices liability insurance (EPLI): This policy covers defense expenses if an employee sues your business for harassment, discrimination, or wrongful termination.

How to get errors and omissions insurance quotes from trusted carriers with Insureon

Complete Insureon’s easy online application today to find affordable errors and omissions insurance coverage from top-rated U.S. companies.

At any point while completing our application, you can consult with an insurance agent on your business insurance needs, such as any endorsements you should consider adding to your omissions insurance policy or how to find affordable workers’ comp and commercial auto policies.

Once you find the right types of insurance programs for your small business, you can begin coverage and receive your certificate of insurance in less than 24 hours.